PicksThe Dangers of a Centralized Black Box in Crypto Trading

A Historic Crash and Hidden Liquidations

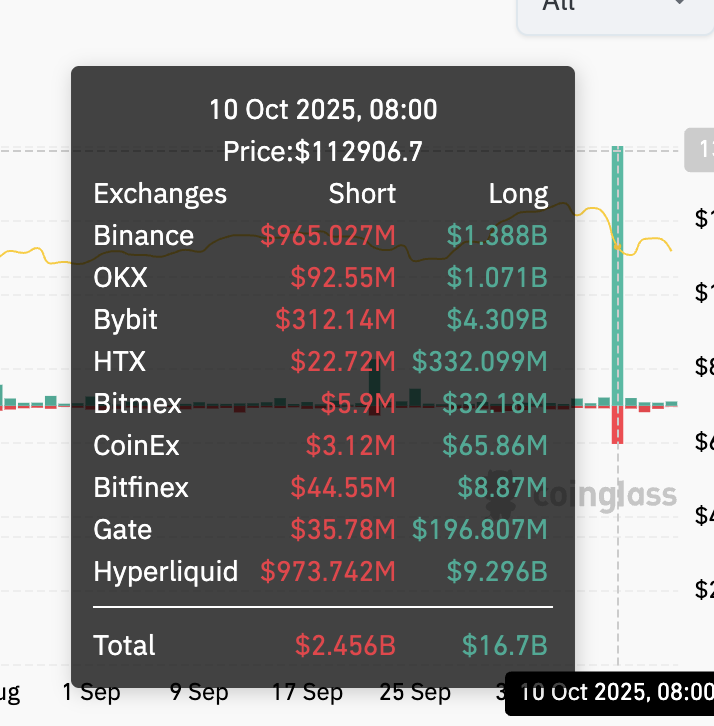

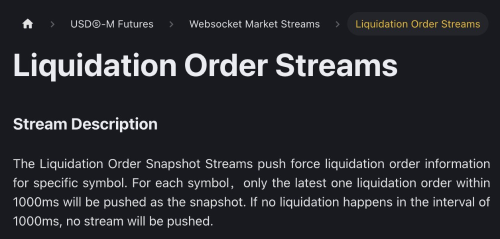

The crypto market’s recent flash crash was unprecedented – dubbed the largest liquidation event in history. Over $19 billion in leveraged positions were wiped out within 24 hours according to Coinglass data, far surpassing past crashes. However, some analysts believe the true damage is even greater. Insiders note that not all exchanges report liquidations in real-time – Binance’s public feed, for example, is rate-limited to one liquidation per second. Because of such opaque reporting, estimates suggest total liquidations may exceed $30 billion, and perhaps even approach $50 billion once all hidden losses are accounted for. These suspicions imply a significant portion of the carnage remains unseen, lurking inside centralized systems that don’t offer full transparency.

This lack of clarity is fueling anger toward centralized “black box” exchanges. Users are frustrated that they cannot verify crucial details like where prices actually bottomed or how many positions were forcibly closed. When billions can vanish behind closed doors, trust quickly erodes. Calls are growing for on-chain transparency to shed light on such events – to ensure the scale of liquidations and their triggers are visible to all, rather than only to the exchange itself. The recent chaos starkly illustrated how a black box design leaves traders in the dark and ripe for manipulation, whether intentional or due to flawed systems.

Binance’s Flash Crash: Opaque Systems and “Zero” Prices

Chart showing Cosmos (ATOM), prices during the Oct. 10 crash. On Binance (Above), thin order books caused extreme wicks to near zero; on other exchanges (Below), the drops were severe but not nearly as catastrophic.

Nothing exemplified the dangers of a centralized black box better than Binance’s handling of the crash. In the mayhem, several altcoins on Binance plunged 99.9% to virtually zero, even as those same coins maintained much higher prices on other exchanges. For instance, Cosmos’ ATOM token briefly printed $0.001 on Binance – essentially worthless – while on competitors like Bybit or Kraken it only fell by 50–60% and never lost all value. This was a Binance-specific phenomenon: no other venue saw these coins go to zero. Such a wild discrepancy underscores how Binance’s internal systems failed to prevent a cascading death spiral in prices that was detached from broader market reality.

Why did this happen? Reports indicate Binance’s risk controls and infrastructure buckled under stress. As prices started tanking, Binance automatically began liquidating users’ altcoins that were being used as collateral on cross-margin accounts. In other words, the exchange’s own “unified” account system dumped customers’ holdings onto the market to cover margin shortfalls – which only accelerated the sell-off in those tokens. This created a vicious feedback loop: falling prices triggered liquidations, which caused more selling and even lower prices. On a transparent on-chain platform, one could observe these liquidations unfolding, but on Binance it was happening inside a closed system with little external insight.

To make matters worse, Binance’s trading engine became overloaded at the height of the crash. Users reported that their accounts were freezing, stop-loss orders failed, and trades were delayed or not executed. During this critical window, major market makers like Wintermute reportedly withdrew their liquidity from Binance due to the platform’s instability. With liquidity providers gone and order matching lagging, there were literally no buy orders for certain coins for a brief period. The result: the order book emptied out and prices for ATOM, IOTX, ENJ and others momentarily flatlined to zero. These tokens still had real value – as evidenced by their prices elsewhere – but Binance’s black box environment showed “zero” because its internal market had effectively broken down.

Binance officials have since apologized for the “extreme volatility” and admitted some systems couldn’t cope with the surge in activity. They promised to compensate users for losses attributable to technical failures (though notably not for losses due to normal market movements). But to many traders, the damage was done. The episode exposed how opaque and centralized Binance’s platform truly is. Traders had no way to see the full picture or protect themselves once Binance’s mechanisms started misfiring. Everything happened within the exchange’s closed infrastructure – a stark reminder that when you trade in a black box, you’re subject to whatever chaos or manipulation occurs inside it, with little recourse.

Exploitation or Design Flaw? The Binance “Margin Cascade”

In the aftermath, a fierce debate has emerged: was this merely poor design or something more nefarious? The lack of transparency makes it hard to know for sure, breeding further distrust. Notably, analysts from Uphold alleged a targeted attack exploited Binance’s system. According to Dr. Martin Hiesboeck, head of research at Uphold, the crash was “suspected to be a targeted attack” taking advantage of a flaw in Binance’s Unified Account margin system. He explained that certain exotic collateral assets used on Binance – like a synthetic USD stablecoin (USDE) and wrapped staked tokens (wBETH, BnSOL) – had their liquidation thresholds tied to Binance’s own spot market prices rather than an external fair price. When panic hit, those collateral assets “depegged” violently on Binance’s order books (e.g. USDE plunged to ~$0.65 on Binance). This instantly gutted the value of users’ collateral, triggering further liquidations that dumped more of the same assets onto the illiquid order books. In Hiesboeck’s words, Binance’s system essentially “dumped [collateral] immediately at any price”, creating a reflexive cascade. The timing was no coincidence, he noted – the attack hit during a brief window after Binance announced a fix to this collateral pricing issue but before it was implemented. He dubbed it “Luna 2,” likening it to a deliberate exploit of a known weakness.

Whether or not one believes it was an orchestrated attack, the incident highlights the perils of closed, centrally-controlled systems. Binance has acknowledged the flaw in how its pricing/oracle logic worked for those collateral tokens and is now rushing to adjust its risk controls. The exchange even promised a “huge compensation plan” for users who were liquidated unfairly due to the USDE/wBETH/BnSOL depeg spiral. But all of these fixes and retroactive payouts are at Binance’s discretion – a stark contrast to how a truly decentralized platform would operate. In a black box, users must trust that the operator will “do the right thing” after the fact. There is no on-chain record to verify what actually happened in those critical minutes, nor any decentralized mechanism to automatically protect traders.

Critics argue that if Binance’s processes were more transparent or algorithmically enforced via smart contracts, such catastrophic cascades might have been mitigated or even avoided. For example, on some decentralized platforms liquidation prices use an index of external markets rather than a single exchange’s order book, preventing an isolated liquidity failure from vaporizing users’ collateral. Binance instead relied on its own internal pricing and paid the price for that decision. Likewise, Binance’s liquidation engine dumped everything in one go, whereas more robust systems perform partial, incremental liquidations or utilize backstop mechanisms to avoid overshooting the market. The bottom line is that Binance’s opaque design and unilateral control made it a single point of failure. Whether by malicious exploit or simply a chain reaction of poor design choices, the result was the same: traders on Binance got a far worse outcome than they would have in a more transparent, algorithmically-governed environment. This has intensified the hatred for centralized black boxes, as users realize how vulnerable they are when an exchange can effectively rewrite the rules (or fumble them) behind closed doors.

Conclusion: A Turning Point for Decentralized Transparency

The dramatic events of October 2025 have drawn a stark line in the sand. On one side are the centralized and semi-centralized exchanges – powerful, fast, but fundamentally opaque and capable of sweeping manipulations or mistakes under the rug. On the other side are the fully transparent, on-chain platforms like Hyperliquid, which might sacrifice a bit of convenience or privacy, but offer the priceless assurance that everything is verifiable and rules-based. The crypto community’s trust has been badly shaken by the former, and their hopes increasingly lie with the latter.

It is telling that even as Binance and Aster tout “privacy” and “secrecy” as features, the loudest voices from traders are demanding “never again” to the kind of blind liquidation massacre witnessed last week. Big-name, well-funded projects like Aster are absolutely capable of delivering the same on-chain transparency as Hyperliquid – they simply choose not to. And that choice speaks volumes. It suggests that despite the lip service to DeFi ideals, some players prefer to keep their operations partly in the shadows, perhaps to maintain control or cater to an elite group of insiders. But the backlash shows that the wider user base has little appetite for another black box wearing DeFi clothing.

In the coming days and weeks, as more data trickles out about the true extent of liquidations (validating those $30–50B estimates) and as investigations into the Binance incident continue, the pressure will mount on all exchanges to embrace transparency or risk exodus. If Aster and others want the community’s trust, they may need to reconsider features that make their systems opaque. The future of trading should not repeat the mistakes of the past, where a select few behind closed doors hold all the cards. Crypto was born from a desire to disempower centralized intermediaries and empower users through transparency and decentralization.

This episode – painful as it was – might be the catalyst that pushes traders and developers firmly toward that vision. The message is clear: No more black boxes. Whether it’s Binance or a new DEX, if it walks and talks like a centralized, secretive system, it will be treated with warranted skepticism. On-chain transparency isn’t just a noble ideal; it’s rapidly becoming a non-negotiable requirement for the next generation of financial platforms. In the end, only those exchanges that operate in the light of day will earn the market’s confidence – and the rest will either adapt or fade away as relics of a less accountable era.

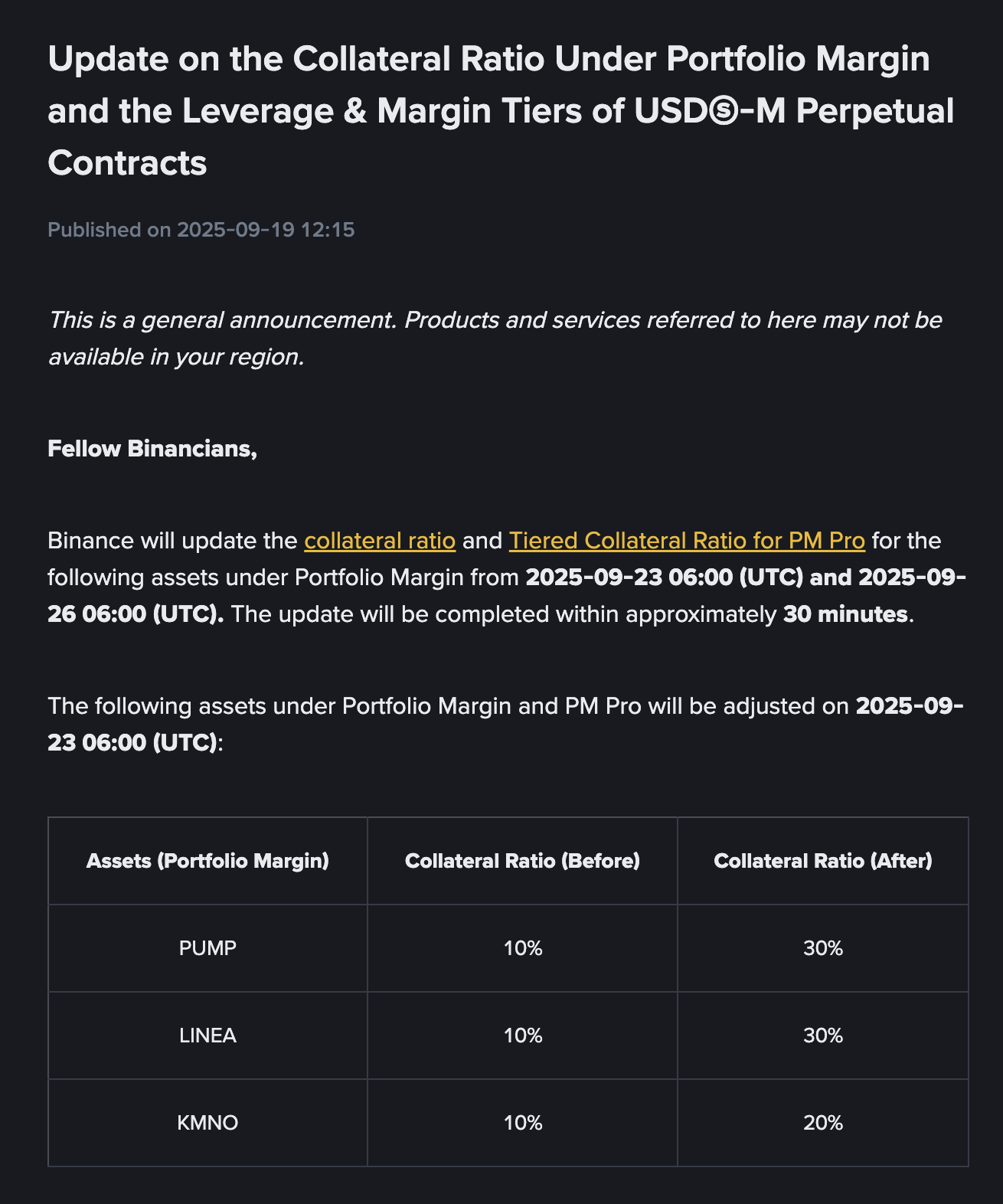

PS: I find a chat share with friend that a few weeks ago, that Binance upraise the collateral ratio of new tokens like PUMP, the 30% means your current 10 dollar worth PUMP collateral enable you to borrow 3 dollar cash to reinvest. And you know some blue chip stock like NVDA you can only have 40% collateral rate from common brokers...