PicksConflict Between HyperLiquid and Binance – Explained

TL;DR: A new crypto trading platform called Aster exploded in popularity in last month, challenging HyperLiquid (a leading decentralized futures exchange). Aster is backed by Binance’s founder “CZ” and uses an off-chain matching engine (meaning its trades aren’t fully transparent on a blockchain). HyperLiquid’s co-founder Jeff Yan champions a fully on-chain approach (every order and trade is public on the blockchain). Since Aster’s launch, Jeff and CZ have been indirectly trading barbs on X (Twitter), with Jeff questioning Aster’s legitimacy and transparency, and CZ defending his project and criticizing HyperLiquid’s stance. Below is a timeline of the conflict, explained for those unfamiliar with the background, with evidence and sources for each key event.

September 2025 – Aster Launches and Overtakes HyperLiquid in Volume

Aster’s Debut: Aster is a decentralized exchange (DEX) for crypto perpetual futures (similar to futures contracts with no expiry). It launched on BNB Chain in September 2025 and quickly gained attention because it was linked to CZ (Binance’s founder). CZ’s family office (YZi Labs) invested in Aster, and CZ publicly endorsed it, giving Aster a big credibility boost. Many saw Aster as Binance’s strategic proxy in the decentralized trading space, likely meant to compete with HyperLiquid.

HyperLiquid Background: HyperLiquid (often abbreviated HL) is a decentralized perpetual futures exchange that launched in late 2024. It runs on its own custom blockchain and uses a fully on-chain order book, meaning every order, trade, and liquidation is recorded on-chain for anyone to verify. This approach aims for maximum transparency and trustlessness, as opposed to traditional centralized exchanges (CEXs) like Binance where matching is done on private servers. HyperLiquid grew rapidly; by mid-2025 it handled hundreds of billions in volume monthly and was the dominant perp DEX.

Aster’s Rapid Rise: Upon launch, Aster implemented aggressive incentives (notably a large airdrop reward campaign for traders). This “trade mining” approach meant users could earn Aster tokens by trading, which fueled a frenzy of activity. In just one week, Aster’s trading volume rocketed from about $11 billion to $270 billion. By late September, Aster’s daily trading volume surged to an all-time high of $60 billion on Sept. 25. In fact, Aster suddenly overtook HyperLiquid in daily volume around that time. This was astonishing because HyperLiquid had been the leader, and Aster was brand new.

Off-Chain vs. On-Chain: How did Aster achieve such performance? Architecture is key – Aster uses a hybrid model where the order matching engine is off-chain (centralized), while settlements occur on-chain. Essentially, it behaves somewhat like a centralized exchange behind the scenes (to get speed and high leverage up to 1001×), even though users still custody funds via smart contracts. This is different from HyperLiquid’s approach, where the matching engine itself is on the blockchain. Aster’s design can offer very high throughput and features like hidden orders and extreme leverage, but it sacrifices transparency – outsiders can’t see every individual trade on a public ledger.

CZ’s Involvement: CZ himself hyped Aster’s milestones on social media. (For example, he touted hitting volume records and even did a public test trade on Aster’s earlier iteration.) Because of CZ’s backing, many in the community flocked to Aster, seeing it as a Binance-affiliated DeFi project. In short, by the end of September 2025, Aster was being talked about as a serious challenger to HyperLiquid, with some even speculating it might overtake HyperLiquid permanently in the DeFi derivatives market.

Late September 2025 – Red Flags: Suspicious Volume Patterns

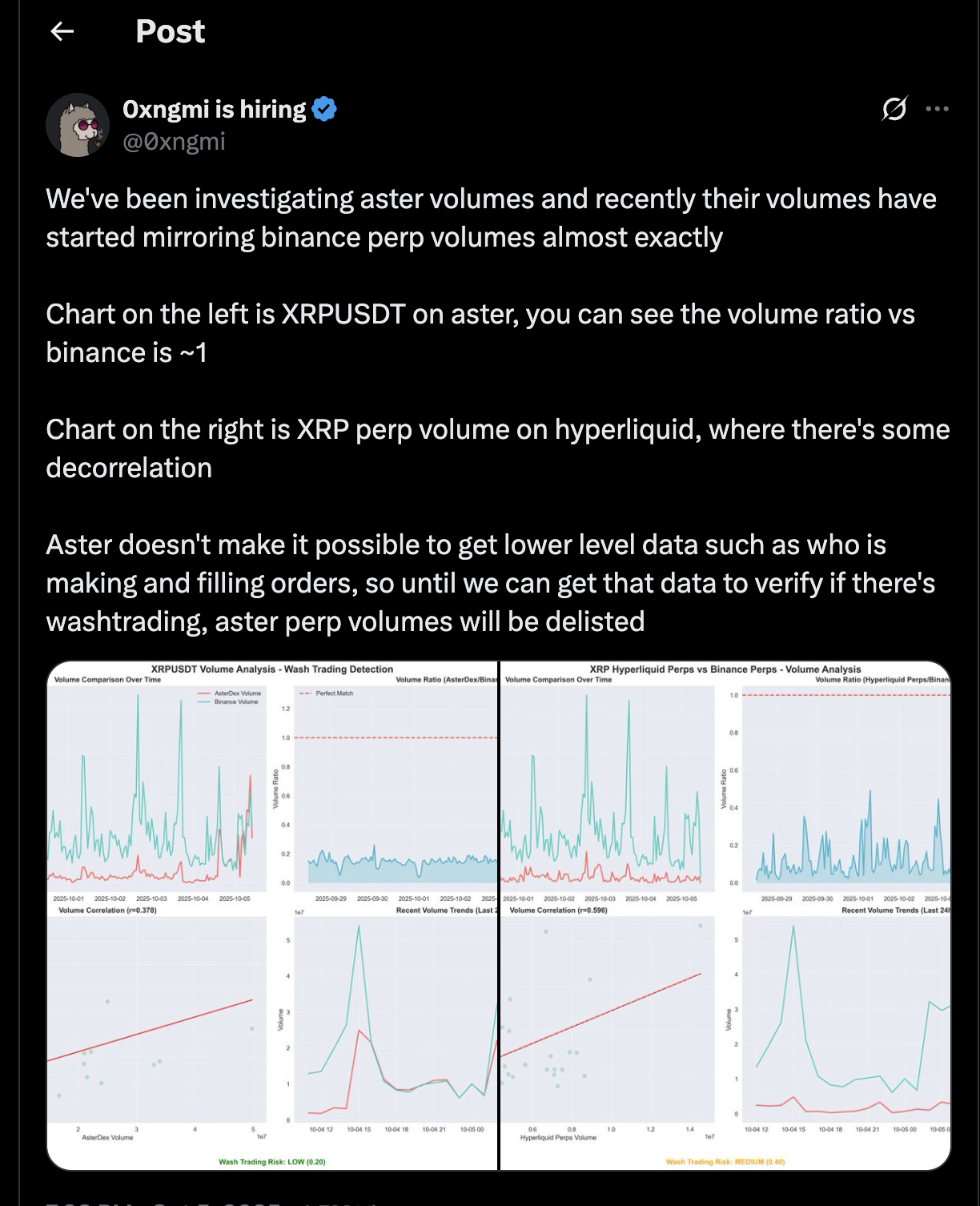

Too Good to be True? Aster’s meteoric rise raised eyebrows. Not only were the volumes enormous, but observers noticed something peculiar: Aster’s perpetual futures trading volume was almost perfectly mirroring Binance’s own perpetual futures volume. In other words, the ups and downs of Aster’s trading numbers matched Binance’s charts nearly 1:1. This is statistically very unlikely unless one is somehow copying the other.

Data Transparency Issues: Normally, if a DEX has unusual activity, the crypto community can verify transactions on-chain. For example, HyperLiquid and other on-chain exchanges allow anyone to inspect every trade in block explorers or by running a node. However, Aster did not provide a way to independently verify its detailed trading data. According to 0xngmi (the pseudonymous co-founder of the analytics site DeFiLlama), “Aster doesn’t make it possible to get lower-level data, such as who is making and filling orders.”. Aster had no public blockchain node or explorer for its trades – outsiders could only see aggregated info via Aster’s API (basically taking the project’s word for it). This lack of transparency meant that if Aster’s team (or insiders) were engaging in wash trading – i.e. trading with themselves to fake volume – it would be very hard to detect. (For context, wash trading is a market manipulation where an entity trades with itself to create the illusion of high activity or demand.)

DeFiLlama Investigates: Given the red flags, DeFiLlama’s team started scrutinizing Aster’s data. The correlation with Binance’s volume was ~1:1, which looked “very, very suspicious,” according to 0xngmi. They couldn’t prove outright fraud, but the pattern suggested something fishy – possibly that Aster’s reported volume was not organic trading, but maybe an algorithm mirroring Binance or coordinated wash trades. Additionally, Aster’s huge volumes were accompanied by a generous trading reward program, which can encourage artificial trading just to earn rewards.

Early October 2025 – DeFiLlama Delists Aster’s Volume Data

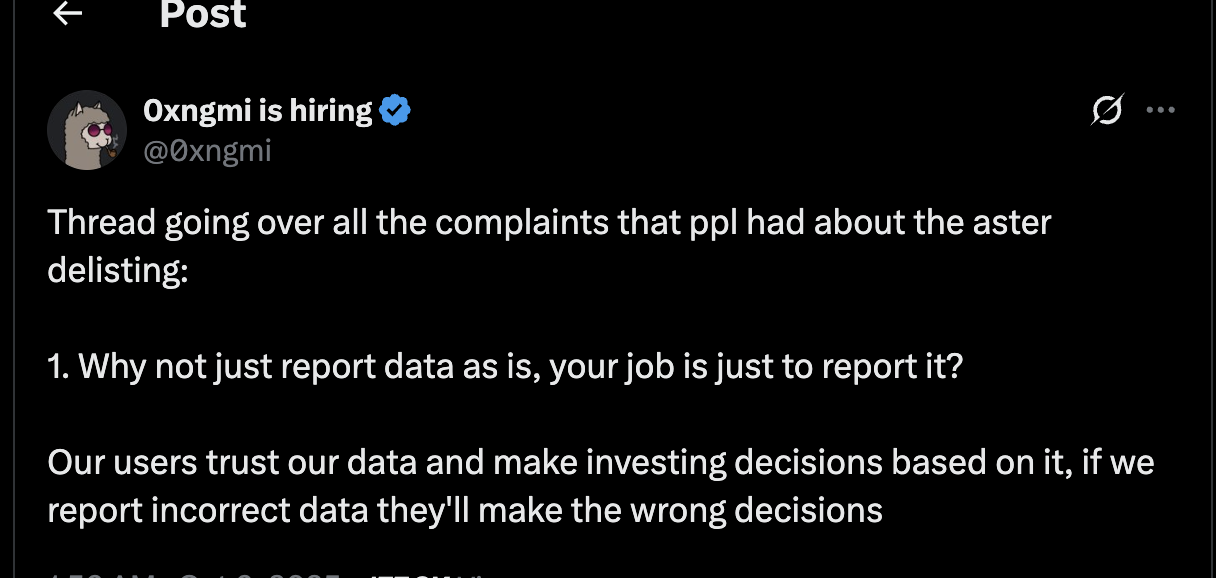

The Bombshell: On October 5, 2025, DeFiLlama made a bold move: it announced it would no longer display Aster’s trading volumes on its site due to these data integrity concerns. 0xngmi publicly stated that until Aster provides verifiable data (like an on-chain transaction log or node software), they couldn’t in good faith include Aster’s stats. “Until we can get that data to verify if there’s wash trading, Aster perpetual volumes will be delisted,” he said. In short, DeFiLlama flagged that Aster’s volume numbers are effectively untrusted.

Market Reaction: This news had immediate impact. Aster’s token price plunged ~10% overnight on the announcement, as confidence in the project’s legitimacy wavered. In the eyes of many traders, if Aster’s volumes were potentially fake, the project’s value proposition was in question. Some community members gloated that “they knew Aster’s volume was fake all along,” though even DeFiLlama’s team cautioned that calling it outright fake was unproven without more data. On the other side, Aster’s defenders argued DeFiLlama shouldn’t pick winners and losers. But the general sentiment was that “where there’s smoke, there’s fire” – Aster would need to come clean with more transparency to regain trust.

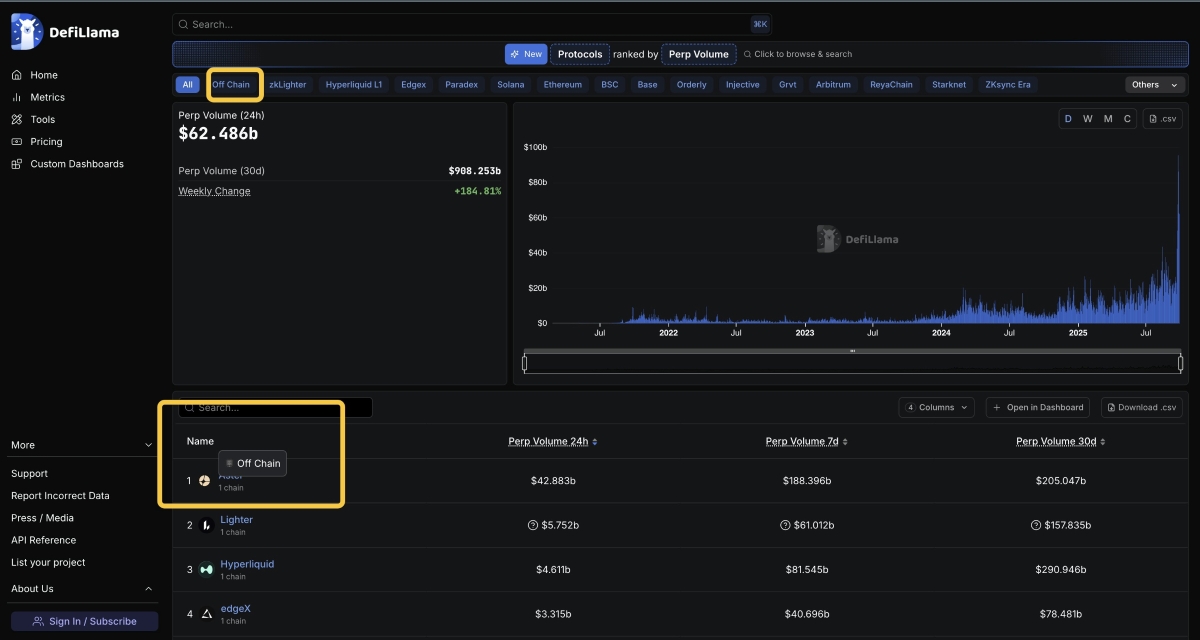

HyperLiquid Back on Top: With Aster’s statistics removed, the DeFi perp exchange rankings reshuffled. HyperLiquid, which had been second to Aster in reported volume, reclaimed the #1 spot in 24-hour trading volume among decentralized futures platforms. In essence, once the possibly inflated Aster numbers were taken out, HyperLiquid was again recognized as the leader in real volume. This was a vindicating moment for HyperLiquid’s team and fans. In fact, even with Aster delisted in volume, it was noted that Aster still showed high fee revenue – suggesting some activity continued, but many suspected the “$100 billion volume” days were over if those had been artificially pumped.

CZ and Aster’s Response: Notably, the Aster team did not immediately provide any on-chain data to counter DeFiLlama’s decision. CZ’s ties to Aster also drew scrutiny here – people wondered if CZ would respond or defend Aster publicly, given his reputation. At this stage, CZ stayed relatively quiet about the delisting controversy. (It’s possible he was handling it privately; publicly, there was no direct statement refuting DeFiLlama’s claims at that time.)

October 10, 2025 – CZ Addresses “AsterLiquid” Rumors (Gossip Tweet)

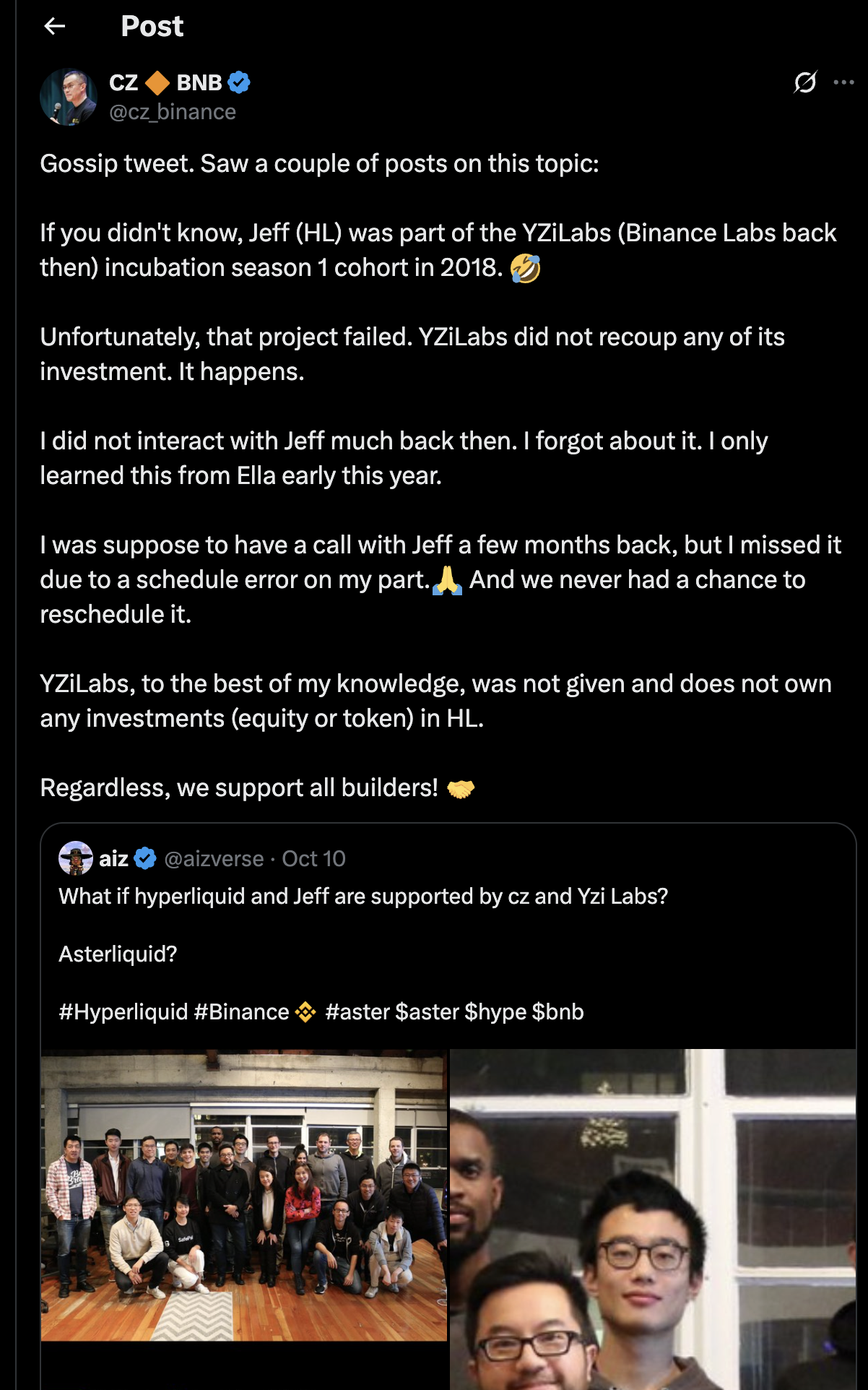

Rumors of CZ Backing HyperLiquid: Around this time, an odd rumor started circulating on X/Twitter: since Jeff Yan (HyperLiquid’s founder) had once been part of a Binance Labs incubator years ago, some speculated that CZ might secretly be backing HyperLiquid as well – a tongue-in-cheek theory dubbing a combined entity “AsterLiquid”. This was likely spurred by an old photo of Jeff in a Binance Labs 2018 cohort and the fact that CZ was involved in both projects’ history (one directly, one indirectly). The speculation was that maybe CZ had a hand in both sides of this so-called DEX war.

CZ’s “Gossip” Tweet: CZ decided to put these rumors to rest. On October 10 he made a post explicitly addressing HyperLiquid and Jeff Yan. He called it a “gossip tweet” and clarified the situation: “If you didn't know, Jeff (HyperLiquid) was part of the Binance Labs incubation season 1 in 2018. Unfortunately, that project failed. YZi Labs (Binance’s venture arm) did not recoup any of its investment. It happens. I did not… [invest in HyperLiquid] …Regardless, we support all builders!”. In this message, CZ confirms that while Jeff was indeed in Binance’s incubator program in the past, Binance got no financial gain from it (Jeff’s earlier startup didn’t succeed). He also noted he had little interaction with Jeff in recent years, implying no secret partnership.

Tone and Community Reaction: CZ’s tweet was unusually blunt in tone, and the community picked up on that. Many felt CZ sounded annoyed or defensive that he even had to address this “gossip.” One user mocked CZ’s post as “insanely bitter… do you hear yourself?”, criticizing CZ for what they saw as a dismissive attitude toward Jeff. On the other hand, plenty of voices jumped in to praise Jeff Yan and HyperLiquid. As one commenter wrote, “Respectfully CZ, credit where it’s due – Jeff basically set the standard for perp DEXes. HyperLiquid walked so the rest could even start jogging.”. In other words, they reminded CZ that HyperLiquid’s innovations had pushed the whole industry forward, arguably enabling projects like Aster to exist. The reaction was mixed, but it underscored that Jeff and HyperLiquid enjoy a lot of community respect, and CZ’s tone may have rubbed some the wrong way.

No Direct Fight… Yet: It’s worth noting that up to this point, Jeff had not directly attacked CZ or Aster by name on Twitter. The tensions were mostly under the surface: HyperLiquid supporters questioning Aster’s legitimacy, and Binance supporters feeling HyperLiquid was benefiting from Aster’s stumble. CZ’s tweet here was a preemptive strike to clear the air on rumors, but it also showed that he was very aware of the brewing rivalry and how people were talking about

October 13, 2025 – Jeff Yan Calls Out Binance; CZ Fires Back (Subtweeting)

Market Crash Backdrop: A few days later, a separate event poured fuel on the fire. On Oct. 10–11, a sharp crypto market crash occurred (Bitcoin plunged from ~$122k to ~$109k in a day). This caused massive liquidations (forced trade closures) across exchanges – over $19 billion worth of positions were wiped out. During this chaos, HyperLiquid shone: it reportedly handled about $50–70 billion in trading volume with no downtime. In contrast, Binance experienced a temporary outage – some users couldn’t close positions for nearly an hour due to technical issues. This left many traders frustrated and nursed losses they felt could have been avoided. The incident highlighted the difference between a decentralized platform like HyperLiquid (which, being on-chain and distributed, stayed up) and a centralized one like Binance (which can have single points of failure).

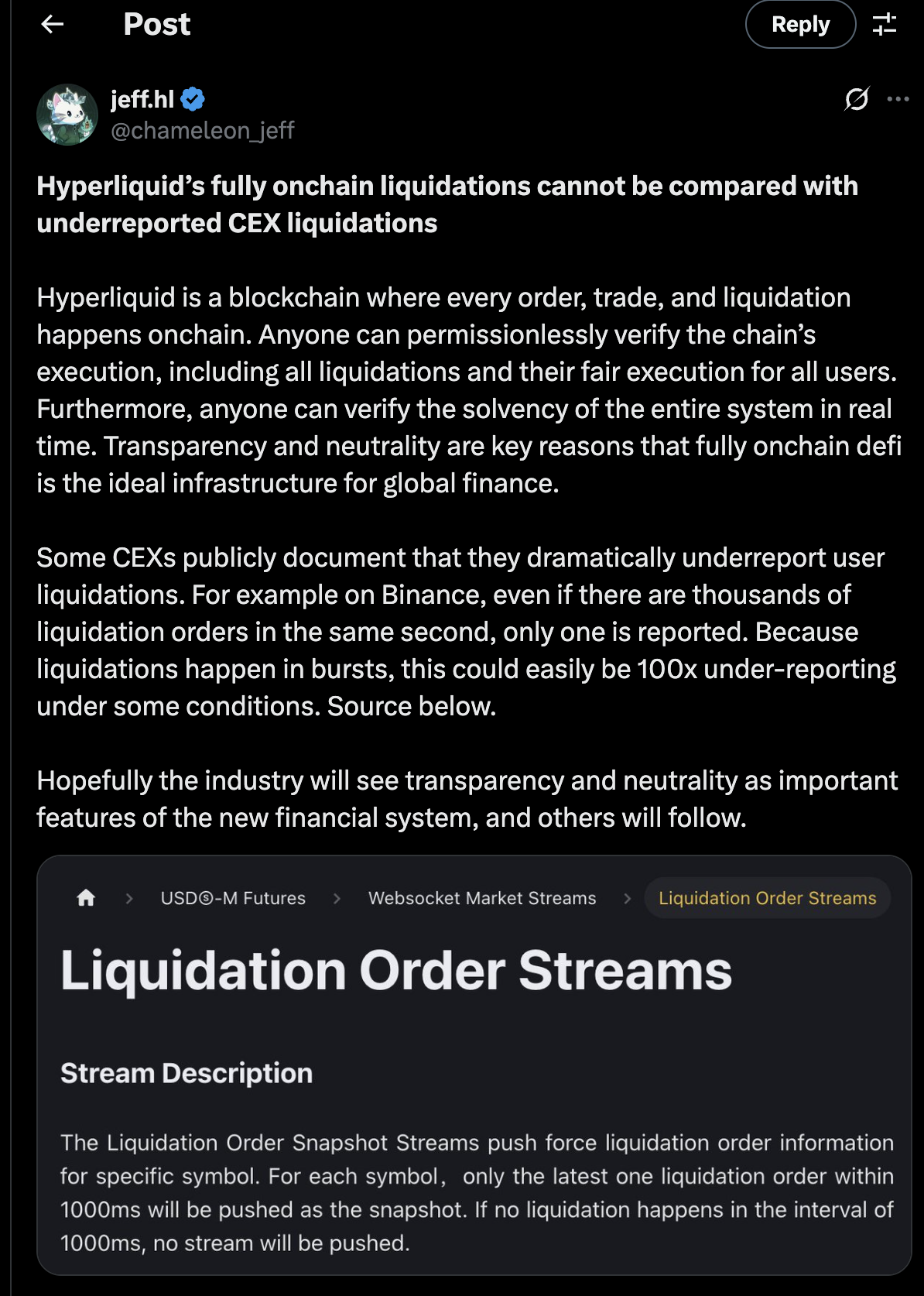

Jeff’s Transparency Push: In the aftermath, Jeff Yan took to X to emphasize how HyperLiquid’s fully on-chain design allows for real-time, transparent reporting of all trades and liquidations. He pointed out that on HyperLiquid, nothing is hidden: anyone can verify every liquidation as it happens, because it’s all on the public ledger. Then he drew a direct contrast to Binance (and by extension other CEXs or hybrid platforms like Aster). Jeff claimed that some CEXs “dramatically underreport user liquidations.” He gave Binance as an example, saying that if thousands of positions are liquidated in the same second, Binance’s public feed might only show 1 liquidation event – potentially 100× less than what actually happened. In Jeff’s view, this is unfair to users, because it conceals the true risk and market impact. He effectively accused Binance of lacking transparency when it mattered most.

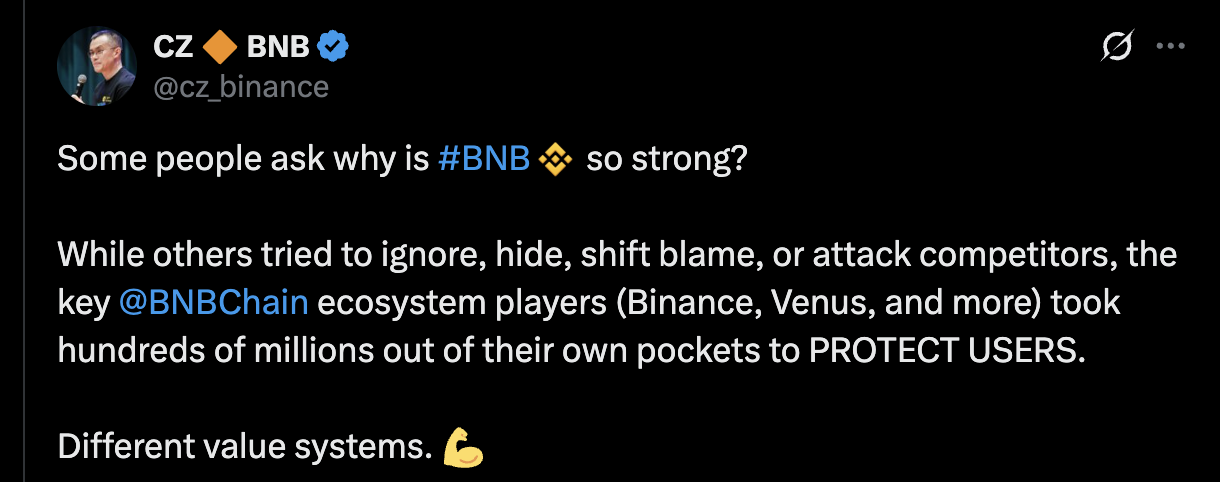

“Different Value Systems”: CZ’s Indirect Reply: CZ did not directly @-mention Jeff or HyperLiquid in response, but a few hours later he posted a message that was clearly aimed at them. CZ wrote: “Some people ask why is #BNB (Binance’s coin) so strong? While others tried to ignore, hide, shift blame, or attack competitors, the key BNB Chain ecosystem players (Binance, Venus, and more) took hundreds of millions out of their own pockets to PROTECT USERS… Different value systems.”. This was a loaded statement. Reading between the lines:

CZ was defending Binance’s actions during the crash, saying they spent money to cover losses or stabilize the system (“protect users”).

He clearly jabbed at “others” who “attack competitors” or “shift blame” – which sounds like a reference to Jeff’s posts highlighting Binance’s shortcomings. Essentially, CZ implied that HyperLiquid’s camp was busy attacking Binance instead of helping users, and that reflects a different ethos (“different value systems”).

CZ’s tweet didn’t name Jeff or HyperLiquid, but the timing and wording left little doubt. It was a rebuttal that painted Jeff’s criticisms as petty attacks during a crisis, whereas Binance (in CZ’s portrayal) was the responsible adult in the room bailing out users.

Escalation of the Feud: This exchange marked the peak of the public conflict so far. Jeff was openly challenging the transparency of Binance/Aster’s model, and CZ was publicly disparaging HyperLiquid (albeit implicitly) as just attacking rivals instead of doing the right thing. Crypto commentators noted that it’s rare to see CZ engage in this kind of tit-for-tat, which shows how high stakes the HyperLiquid vs. Aster battle had become.

What’s the Big Deal? (Why This Conflict Matters)

On-Chain vs. Off-Chain Debate: At its core, the Jeff vs. CZ spat is about two different visions for crypto trading. Jeff Yan and HyperLiquid advocate for full on-chain transparency – everything out in the open, which prevents any hidden manipulations and holds platforms accountable. CZ argues that a bit of opaqueness can be acceptable or even beneficial (or the possibility of manipulate), if it yields better performance or user experience. In fact, CZ has praised Aster’s design for offering “privacy” on large trades – since Aster’s order book isn’t public, big traders can move without immediately telegraphing their positions. He suggested that this privacy feature could be “better” than HyperLiquid’s transparent order books, depending on one’s perspective. This is a philosophical difference: Do we prioritize transparency (and decentralization), or is it okay to trust a platform if it gives us higher speed and maybe some trader anonymity? The answer influences how “decentralized” a DEX really is.

Integrity of DeFi Metrics: The conflict also highlights the issue of trust in reported metrics. HyperLiquid’s volume and liquidations can be verified by anyone on-chain, so it’s hard to fake those numbers. Aster’s skyrocketing volume, on the other hand, fell into a grey zone – we had to trust the team’s API, which goes against the crypto ethos of “don’t trust, verify.” DeFiLlama’s decision to delist Aster’s volume was a watershed moment: it sent a message that the community values honesty over hype. If a project can’t prove its volume isn’t fake, it might lose the benefit of the doubt. This may set a precedent for other platforms that rely on off-chain mechanics: they could face skepticism unless they find ways to increase transparency.

Personalities and Influence: The drama is also compelling because of the people involved. CZ is one of the most powerful figures in crypto, and seeing him in a public spat is noteworthy. Jeff Yan, while far less famous, has quickly built a reputation as an innovator with HyperLiquid’s success. He’s also somewhat of an idealist for on-chain technology (and notably, HyperLiquid has no VC funding – a rarity, it was built by a small team of ~10 and grew organically). This underdog story – a tiny fully-decentralized team vs. a Binance– has captured the community’s imagination. It’s often framed as a kind of David vs. Goliath (or “DeFi vs CeFi”) narrative. When CZ tweeted in that brusque tone, many rallied to defend the “little guy” (Jeff), showing the strong community sentiment for decentralization principles.

Impact on Users: For regular crypto users, this saga is a bit of drama but also a learning moment. It underscores questions you should ask when using a so-called DEX: Is it really decentralized? Can you verify what’s happening? In HyperLiquid’s case, you can audit the platform’s every move on-chain. In Aster’s or Binance's case, you currently cannot – you trust their word. That doesn’t automatically mean Aster is doing anything bad, but as DeFi users learned with various scandals, blind trust can be risky. The fact that Aster’s volume could have been exaggerated means traders could be misled about liquidity and market depth. So, the debate has practical implications for where people trade and how safe they feel.