PicksClarity Act was just the beginning — this long bull might really have legs 🐂

When I first saw the Clarity Act, it struck me as tailored for major Layer1s — providing regulatory clarity mostly for the big players. But I kept wondering: what about the rest of the crypto world? Especially those not building DeFi protocols or sitting neatly under SEC exemptions?

Now it all makes sense.

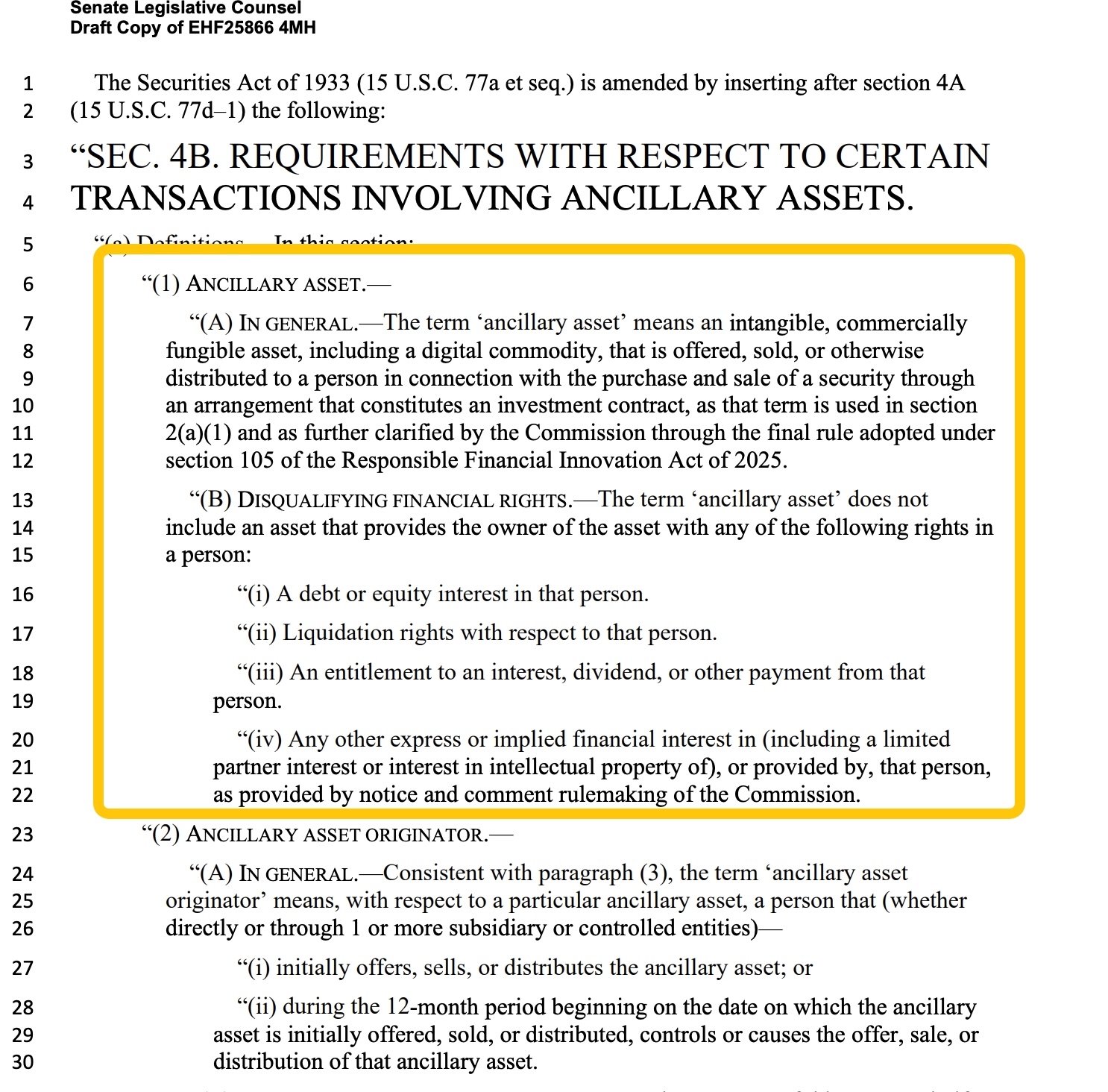

The new Senate draft introduces the concept of "ancillary assets" — basically utility tokens with no debt or dividend rights — and gives them a self-certification path to avoid being classified as securities. Smart move.

Looks like the U.S. is piecing together a legal framework step by step, plugging the gaps across asset types.

If they keep rolling these out, we’re not just in a bull run — we’re in a structurally supported one.

https://www.banking.senate.gov/imo/media/doc/senate_banking_committee_digital_asset_market_structure_legislation_discussion_draft.pdf