mcsquaredfi

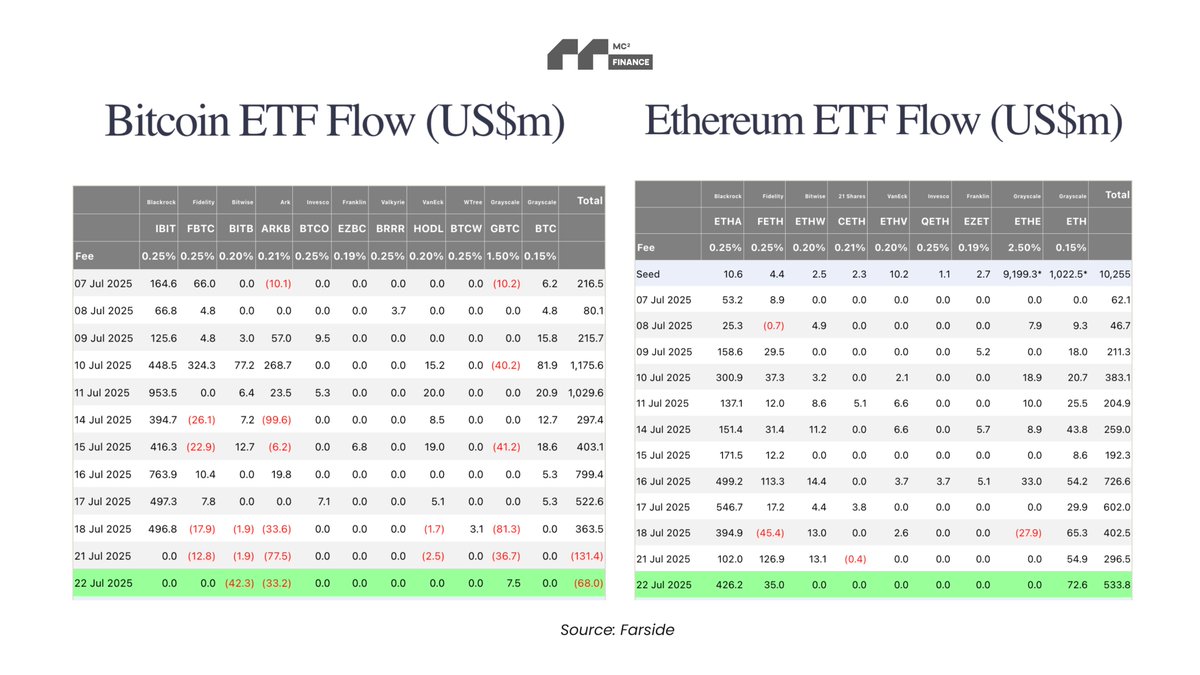

→ Bitcoin ETFs: –$68.0M outflow

→ Ethereum ETFs: +$533.8M inflow

Institutions are shifting. Again.

On July 22nd, U.S. Bitcoin ETFs recorded a net outflow of $68.0M

Following an even sharper outflow of $131.0M just one day earlier.

At the same time, Ethereum ETFs saw a surprising $533.8M inflow, the largest since their launch.

→ Top sellers: Bitwise & Ark

→ Top buyers: BlackRock ETHA & Fidelity FETH

This rotation could reflect:

1. Profit-taking on $BTC after recent rallies

2. Growing confidence in Ethereum post-ETF approval

3. Anticipation of $ETH’s yield narrative taking hold among institutions

While Bitcoin still dominates in AUM, this shift in flows might hint at how institutions view $ETH’s asymmetric upside.

All You Need to Know in 10s