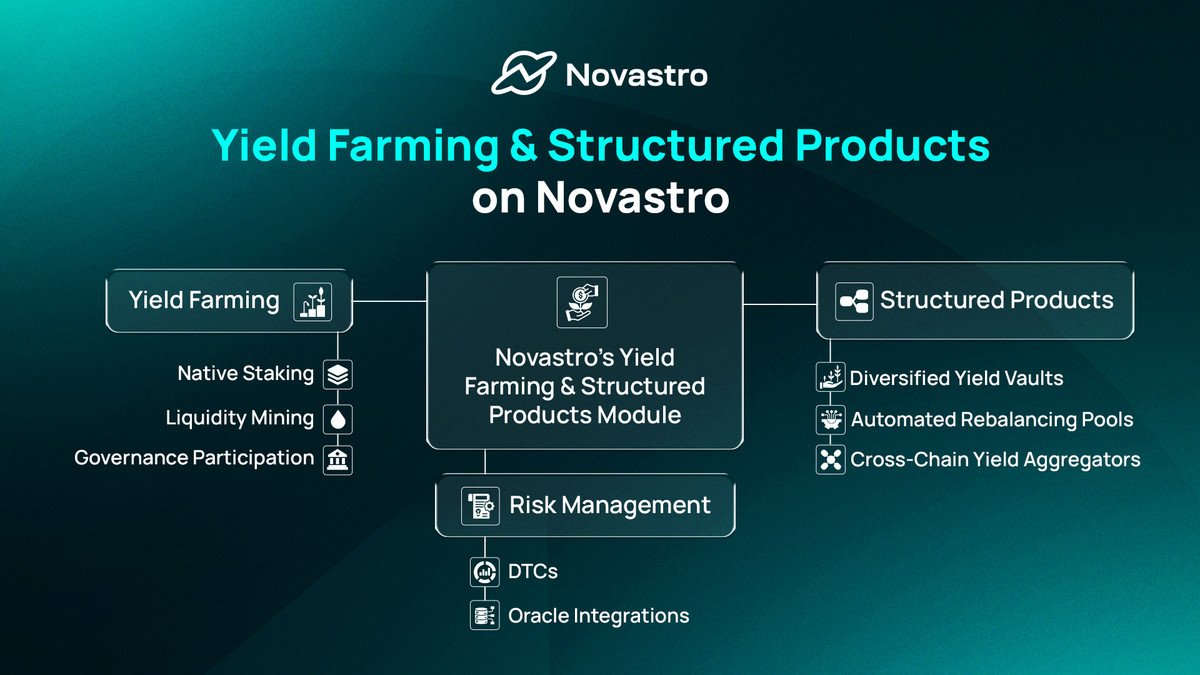

As part of our mission to make real-world assets yield-bearing and DeFi-native, Novastro is building its Yield Farming and Structured Products infra.

Native staking, liquidity mining, and governance rewards help bootstrap early liquidity and reward active participation. RWA holders can earn more from their assets while shaping the ecosystem.

Structured products open up risk-adjusted returns for both passive and active investors. Users can deposit into diversified yield vaults that hold real estate or loan-backed tokens and earn blended yields. Automated pools rebalance using live on-chain data to protect capital through market shifts.

Cross-chain yield aggregators deploy capital where it performs best. Risk is managed through DTC-backed legal links, oracle price feeds, loan updates, and transparent compliance.

Real yield. Real assets. Fully onchain with Novastro.