SoSoMacro

U.S. June retail sales exceed expectations; U.S. labor market remains resilient; Fed officials speak.

Market Performance:

Here’s today’s SoSoMacro Recap — spotlighting the key signals driving markets at this moment:

1. U.S. June retail sales exceed expectations: The "control group" retail sales directly counted in GDP calculations also rose 0.5% month-over-month in June, further confirming strong consumer spending and easing market concerns about declining consumer expenditure.

2. Labor market: U.S. initial jobless claims fell for the fifth consecutive week to the lowest level since mid-April, while continuing claims remained essentially unchanged, indicating sustained labor market resilience.

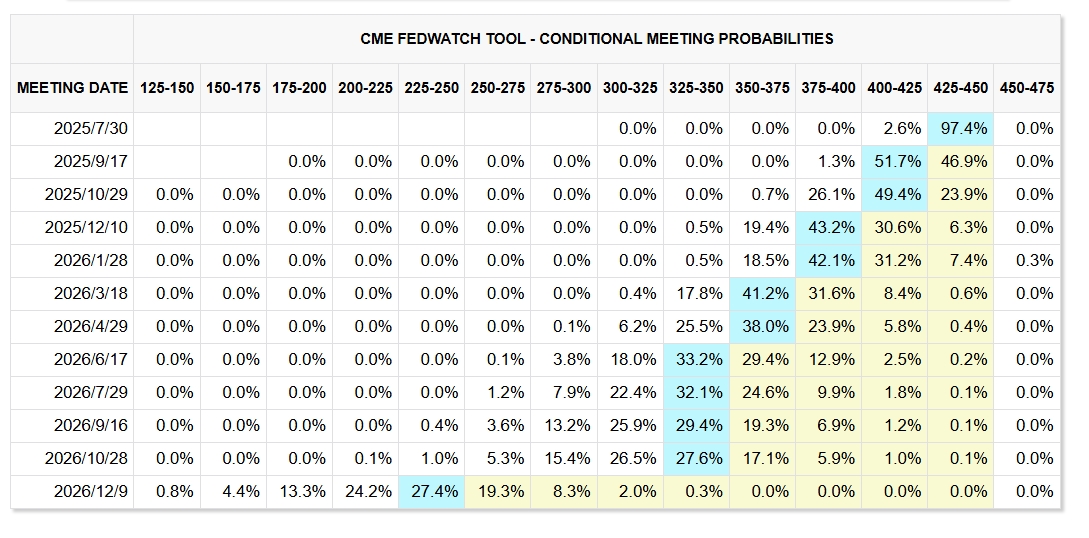

3. Fed officials speak: Most still support continued observation, with some voting members beginning to hint at initial tariff impacts emerging, reducing September rate cut odds to 50-50. Daly maintains expectation of two rate cuts this year, while Waller still supports July rate cut.

4. Tariffs: U.S. Commerce Department plans to impose preliminary tariffs of up to 93.5% on imported Chinese graphite, primarily targeting battery-grade graphite used for electric vehicle battery anodes, with final rates expected to be announced before December 5, 2025.