Everybody has their own opinions on tokens like $PUMP, $HYPE, $JUP & $RAY, but you can't argue that them outperforming is a HUGE win for revenue-driven tokens.

People are starting to realize that a token that is backed by tangible value > a token that is backed by nothing, and revenue-driven microcaps seem to be catching bids.

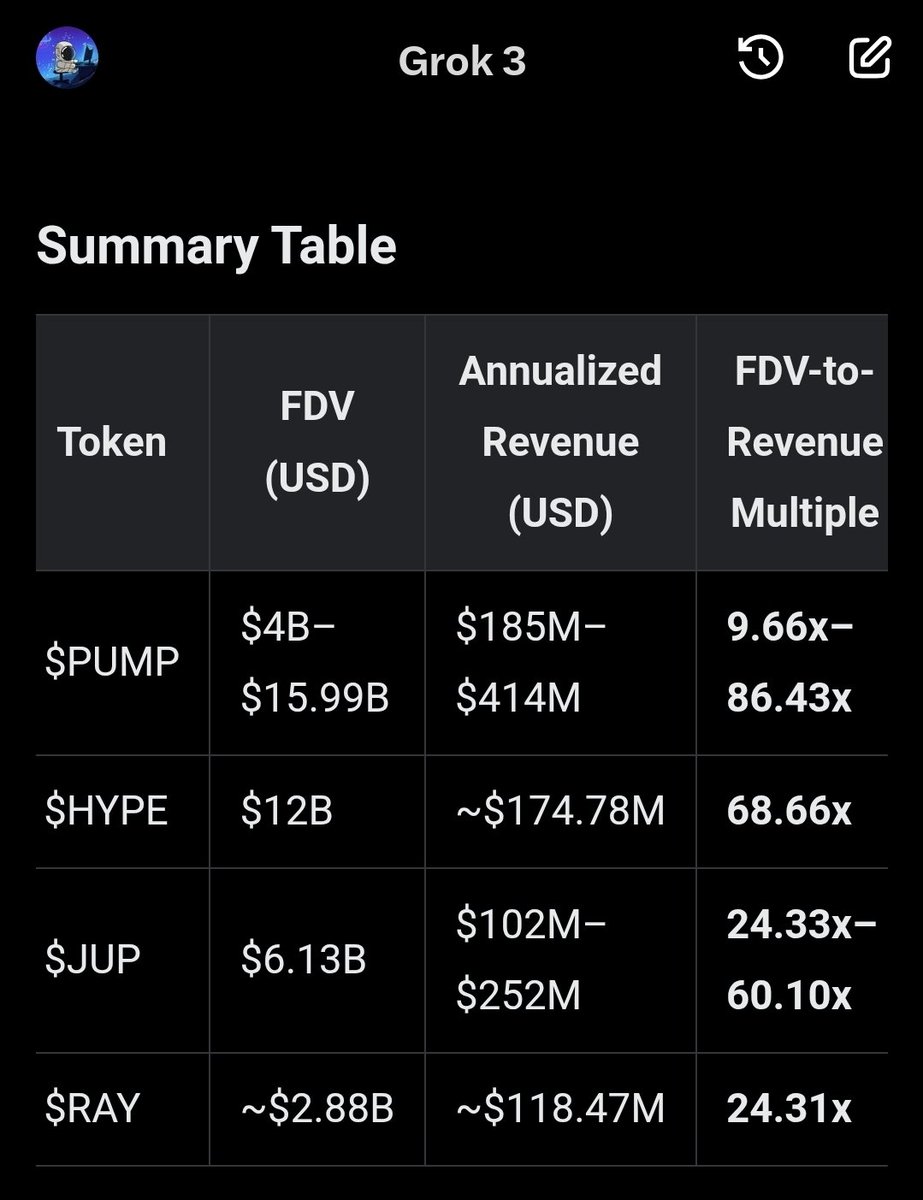

Revenue is also one of the only real identifiers we have to "value" a token, so out of curiosity I asked Grok to run some numbers, comparing the FDV-to-revenue multiples of these coins and seeing how other projects, in this case $INFLU (because why wouldn't I insert one of my own incubations here), compare to them.

This is fully based on Grok's data, and I fully understand I can't compare tokens worth billions vs a 150k mcap coin, but it paints an interesting picture.

$PUMP -> 9-86x multiple

$HYPE -> 68x multiple

$JUP -> 24-60x multiple

$RAY -> 24x multiple

Now lets compare that to @InfluenceHerMgt.

$7200 in revenue with 2 models last month.

$86000 annualized (based on their first month and 2 models, they've recently onboarded model #3 and aim to onboard much more).

Based on the lowest multiple (9x from $PUMP), that'd value $INFLU at 774k mcap.

Based on the highest multiple (86x from $PUMP), that'd value $INFLU at 7.4M mcap.

It is currently trading at 150k mcap. Curious to see over the coming months if the top coins will be repriced lower, or if $INFLU and other revenue generating microcaps will be repriced higher.