Some recent small discoveries about Binance listings:

1️⃣ Binance $Alpha has become the basic threshold for listing on Binance's secure channels. Whether it's futures/HODLer/Launchpool, they all need to be on $Alpha first, but whether or not there's an airdrop is another matter. Refer to the recent two projects $HOME and $RESOLV, which are like this: $Alpha > Futures > HODLer

2️⃣ The pace of Binance's HODLer airdrops is accelerating. There were a total of 3 in May, and in just over half of June, there have already been 4.

3️⃣ The returns from Binance HODLer are gradually becoming fixed. According to the previous few periods of returns, approximately 1 $BNB corresponds to $0.3 of airdrop rewards.

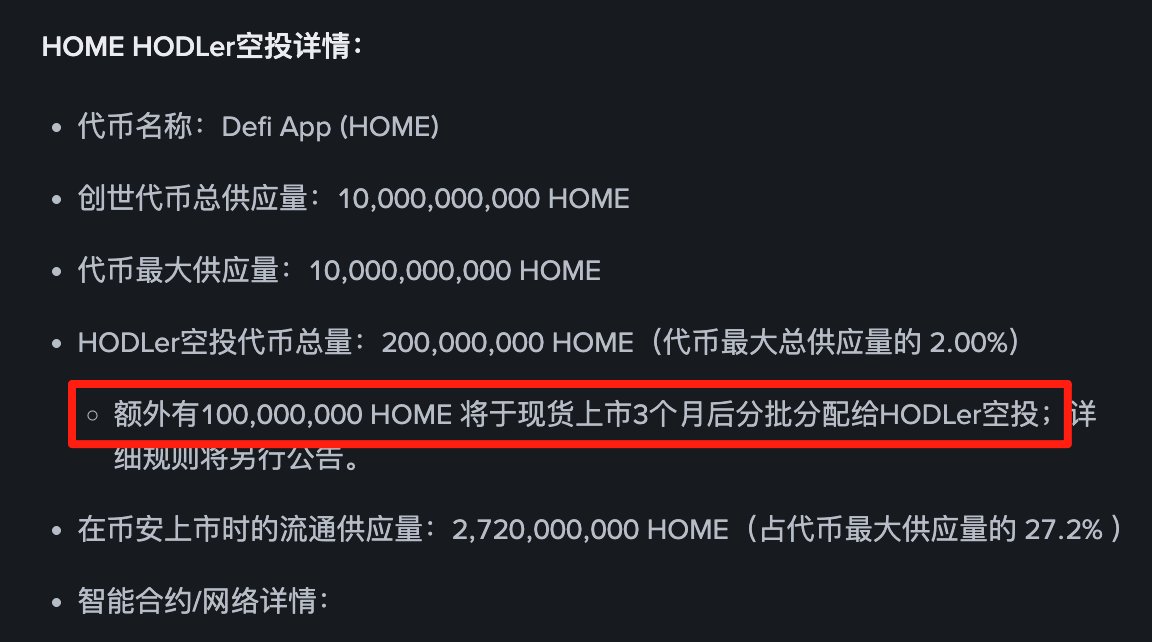

4️⃣ More and more project teams are adopting Binance HODLer's phased airdrops. For example, $HOME is divided into two phases: 2% of the tokens (i.e., 200 million) are distributed at once, and an additional 100 million will be distributed in batches 3 months after spot listing. On the one hand, this alleviates the "selling pressure caused by excessive airdrop concentration," and on the other hand, it increases additional exposure. After all, every time there's an airdrop, you will "see" the project again.