Fundraising in Web3 doesn't need to be complicated!

There are three major obstacles in fundraising that don't have easy solutions. Do you know if your project is suffering from them? 🤔

Let us help you understand which are these challenges and how ApeBond can help overcome them.

🧵

(Remember to bookmark this post to come back later!📚)

1️⃣ Lack of Funding options

The First Challenge is a lack of access to more traditional funding sources, such as Web3 Venture Capitals (VCs).

This market has been fluctuating heavily in recent months and it's far from its formal glory in 2022 👇

For these reasons, many projects rely on ICOs and other, "self-funding" methods that involve community participation

While this method has its benefits, it's highly competitive as well, with many other platforms and projects disputing for community attention.

At ApeBond we offer a different solution 🐒

By making traditional financial mechanisms decentralized and community-powered, our bonding strategy allows projects to tap into Over The Counter markets (OTC), at any point of their lifecycle.

Your project can leverage ApeBond's expertise in the area to access OTC sales, where it's easy to turn native tokens into stable coins or blue chips by selling them to users at off-market rates, vested over time.

This approach:

• Ensures gradual market integration

• Protects token value

• Foster Sustainable Growth of a Project

• Engages your community and generates holders

This way, projects can raise funds with our Bonds while users acquire their favorite tokens at discounted rates.

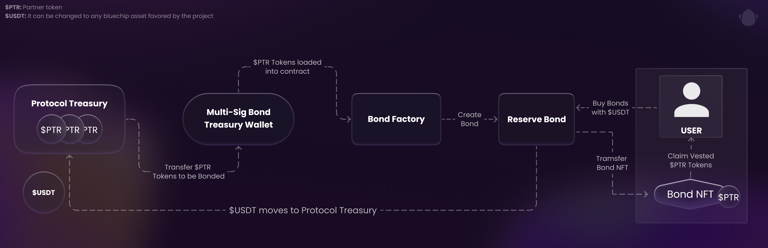

Our product allows users to acquire tokens at a discount that vest over time, represented by an NFT, in exchange for a single underlying asset.

The "Bond NFT" offers yield tokens that become claimable to the holder incrementally.

2️⃣ Insufficient Liquidity

After the initial fundraising challenges, asset liquidity is a project's next make or break. Insufficient liquidity prevents the tokenomics from flowing and functioning properly, freezing the project's growth and stability.

One of the main desires for investors is assurance that they can easily enter and exit their investments, keeping their assets flexible to their needs.

By being a pioneer in Bonding, ApeBond can offer your project the ideal bond structure that fits your specific needs.

Our Liquidity Bonds can help you seamlessly raise Liquidity Provider (LP) tokens of the pair you prefer, effectively turning native tokens into Protocol-Owned Liquidity (POL).

This and other solutions are prepared with great care to ensure that funds are readily available, helping projects maintain the liquidity needed for sustained growth.

We also include a Liquidity Health Dashboard of our partner's projects in our platform so you can have real-time info, among other features.

3️⃣ Low Return on Investment (ROI)

Another major challenge in fundraising is low ROI. Standard options like Market Makers or Centralized OTC have an average ROI of just 65% at best.

ApeBond, however, boasts an 87% average ROI, with some projects even achieving a full 100% ROI. This showcases how effective Bonds can be when raising capital with native tokens without losing value.

To top this off, there’s an additional, secondary return in the form of community engagement.

Unlike standard centralized OTC, which is usually hidden from users, ApeBond allows users to actively participate, get engaged, and become long-term holders as they vest your tokens over time.

This unique approach drives higher financial returns while creating a stronger, more involved community around your project.

4️⃣ Final Comments

Is there anything else? Or maybe you have suggestions for further development?

Access the link below and become a partner!

➡️https://t.co/XwiiLajiMQ

Together we're stronger 🤝