Berachain: The L1 Killer Of The Cycle?

There’s a reason why Layer-1 Blockchains (L1s) are one of the most sought-after investments in crypto.

Done right, they can give early investors game-changing returns, anywhere from 50-100x on their initial investment. Imagine investing into AVAX’s ICO at $0.5 before it ran to 120, or getting into SOL at single digits before it ran to $240.

The L1 trade is betting on an ecosystem, betting that its blockchain technology and the projects building on it will gain retail adoption and provide huge multiples long term.

In this thread, we’ll cover all the reasons why Berachain has the potential to be THE L1 to outperform all other shiny new L1 coins this cycle.

With its innovative tokenomics, grassroots approach, and cult community... we'll also share an easy way crypto investors can get institutional-level exposure Berachain through NAV.

The Problem That Plagues Blockchains - Most Liquidity Isn’t Sticky

The majority of L1s see waves of “vampire” liquidity that bridge onto the chain, farming the protocols and yield farms on it to extract gains and move on to the next trade.

This issue stems from how most L1 tokenomics are set up. The token of the L1 is the sole token of the ecosystem, with it used for staking governance, staking rewards, and gas for transactions.

While commonplace in crypto, this can lead to issues such as:

• Governance attacks via whales staking solely to propose and vote for their own benefit above the L1

• Relentless sell pressure of the L1’s token if stakers are only rewarded in the same token - leading to coins/projects on the L1 suffering in tandem and losing momentum

• Ghostchains where after speculators and traders have extracted value, little activity remains, because there are no incentives for them to stay on the chain

Berachain’s tokenomics flips this power structure on its head by incentivizing “sticky liquidity”

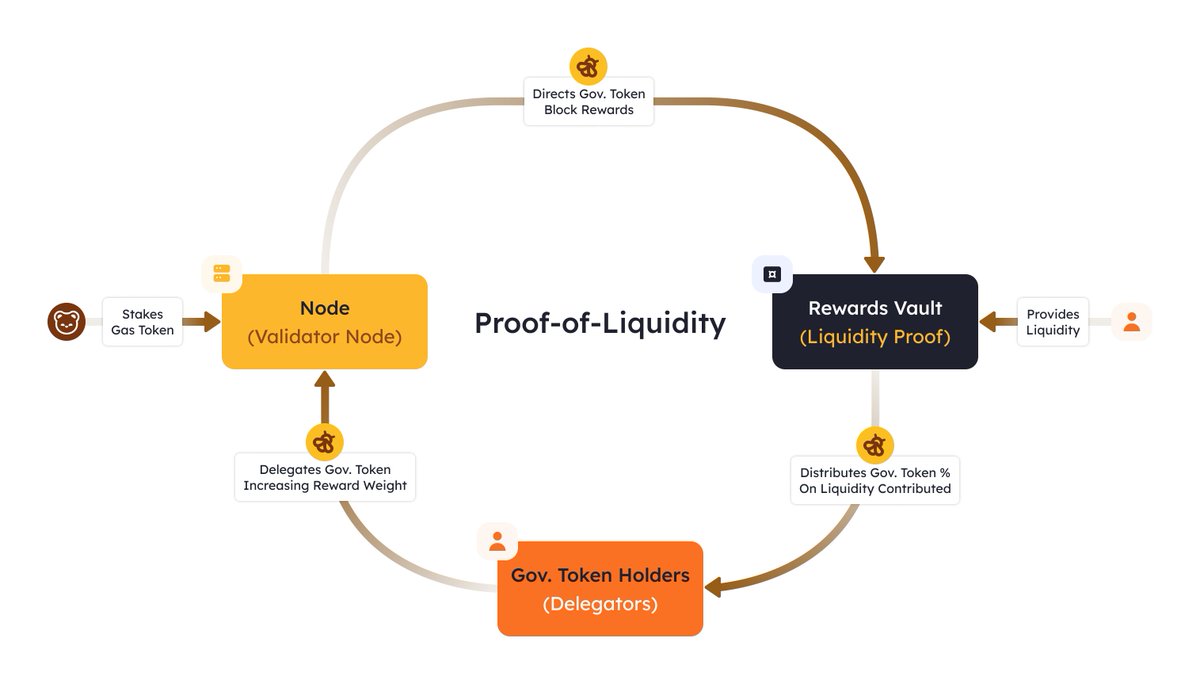

Berachain will run on Proof-of-Liquidity (POL) with 3 tokens:

$BERA - the main token of Berachain that is used for gas transactions.

$HONEY - the native stablecoin of Berachain, pegged to $USDC, fully backed by whitelisted collateral.

$BGT - the governance token of Berachain that allows holders to vote on bribes and governance within Berachain. $BGT cannot be transferred but can be burned for $BERA.

As $BGT is only emitted by providing liquidity for POL-eligible assets (e.g. liquidity on Bex), governance is in the hands of those who believe in Berachain’s long-term sustainability.

Could This Cycle See The Rise of "$BGT Wars"?

Berachain's tokenomics solves the incentive structure that often lead to liquidity and participants leaving an ecoystem after extracting gains.

But by making it rewarding to remain, and creating a positive flywheel effect of $BGT becoming a sought-after token for its governance and voting powers...

This leads to participants wanting to accumulate $BERA, providing liquidity for $HONEY, and acting in Berachain’s best interests.

Participants from the last cycles may recall the infamous "$CRV wars" over the gauge and bribes $CRV gave liquidity providers... pushing it to a peak valuation of $2.4b.

It's early, but we might see such dynamics emerge with $BGT emissions and the control they give over Berachain's bribes and governance.

Berachain’s Tech

Berachain uses BeaconKit, the modular framework developed by the Berachain team. It integrates all the benefits of the Cosmos SDK, such as increased composability, single-slot finality, and more.

And Berachain’s execution layer is identical to the EVM runtime environment seen on the Ethereum Mainnet.

This means Berachain can adopt any new EVM upgrades straight out of the box.

With Proof of Liquidity as its consensus mechanism, Berachain will launch with native dApps such as BEX, Bend, and Berps on day-one, giving reference to how developers can build on top of Berachain’s POL mechanism.

From The Grassroots... Comes The Best $Honey

Where Berachain stands heads and shoulders above other L1s this cycle is the continuous community building they’ve done ever since the first Bong Bear NFT collection.

The total secondary trading volume of all Berachain-related NFTs currently stands at over 30,000 ETH: https://t.co/iip0Fz60tg

That’s over $73m worth of trading from crypto participants speculating, and wanting to get involved with Berachain!

Beyond that, Berachain is estimated to have over $100m in capital committed from investors and builders to deploy into their native dApps upon mainnet launch.

Most market participants know the bread and butter of L1s are its dexes, memecoins, NFT collections, and basic DeFi protocols (lending, options, liquid restaking, etc.).

But Berachain is slated to have unique, innovative dApps launched on it once it’s live… leagues above the competition from the start.

Berachain may have begun as a simple collection of Bong Bear NFTs, rebasing into Bond Bears, Boo Bears, Baby Bears, Band Bears, and Bit Bears, with a final rebase on the way.

But 2 years later, Berachain’s community of holders, builders, and developers have captured an insane moat and mindshare across the entire cryptosphere.

How NAV Is Preparing For Berachain

NAV will have our Berachain Maximizer SIP launch upon mainnet. It's specifically focused on capturing the opportunities of Berachain and making NAV a significant player on it from day one.

We’ve got over $2.2m worth of Bear NFTs waiting in the SIP, and will allocate any airdrop of $BERA upon mainnet into it.

We’ve already got our team of researchers and analysts working round the clock looking for the best opportunities on Berachain to reinvest our $BERA, be it in new DeFi protocols or upcoming yield farms.

Our Berachain Maximizer SIP gives investors access directly to our strategies on Berachain, and to gain easy exposure to the possible returns of its mainnet.

There are very few funds publically giving retail investors a hands-off, institutional-level product to gain Berachain exposure... we might even be the first!

On Berachain, we’ve got our eyes on these projects:

DePIN (Decentralized Physical Infrastructure Networks) - We’re watching @puffpaw_xyz with their Vape2Earn protocol. With nicotine-free, organic e-liquids, PuffPaw will incentivize users of their vapes to both quit smoking, and earn their token simultaneously!

GameFi - We’re watching @BeratoneGame, an online multiplayer game with farming, fishing, and crafting, alongside digital collectibles. We’ve already got exposure to their NFTs, but expect their game to be a possible GameFi leader on Berachain.

Dexes - It’s @KodiakFi we’re eyeing closely. Incubated by @buildabera, they’ve got their app live on bArtio testnet to the public.

DeFi - @goldilocksmoney is live on bArtio, building Goldiswap (an AMM), Goldilend (a NFT lending platform specifically for Bong Bear NFTs & their rebases), and Goldivaults (allows trading and speculation on yield bearing positions on Berachain)

(Shoutout to @Berabaddie as well)

Berachain Is Real - And So Are Its Opportunities

Very few L1s can combine innovative technology with an organically grown community, and when they do, they’re often the trades for the cycle.

We believe Berachain is positioned to pull this off. We expect there to be countless opportunities on mainnet to invest in the next billion-dollar protocol, yield farm, and more. With over $3.7m already invested into Berachain, we'll be using our Berachain Maximizer SIP to further invest and grow NAV to new heights.

SOL peaked at a valuation of $67b last cycle, and Berachain’s last fundraise round led by Brevan Howard Digital and Framework valued them at $1.5b.

Considering SOL may grow multiples of its previous peak valuation, raising the ceiling on what non-$ETH L1s can achieve - the meme of $BERA eventually being valued at $42b this cycle may not just be a meme.

And with that moon math for $BERA, what's to say of the possible gains of the protocols and projects on the chain itself?

We'll be in the Berachain trenches from day one, determined to capture any available upside.

So for investors who want to put their $HONEY to work, and not work for their $HONEY…

Our Berachain Maximizer SIP will be opening soon for deposits.

Simply put…

Ooga Booga