Wallfacer Weekly (#2)

Here’s a roundup of what piqued our interest this week:

- Gauntlet shifts allegiance from Aave to $Morpho

- Mike Neuder and Tarun Chitra explore risks of #LRTs in #DeFi

- GFX’s partnership with Uniswap goes live after governance vote

- Yearn x Ajna’s juiced vaults now on @vaultsfyi

Gauntlet shifts allegiance from Aave to $Morpho

📰 Story: In the last Wallfacer Weekly, we covered @gauntlet_xyz's split from @aave. In a further turn of events, @MorphoLabs announced their newfound partnership with the leading DeFi research firm. With Aave recently targeting $Morpho's optimizers, this move comes as a surprise to many — signaling a shift of allegiances in the sector.

💡 Our Take: Something we have discussed internally over the last few months has been the trend of service providers (Gauntlet being a key example) that are monetizing by providing services rather than building protocols of their own. Gauntlet’s fees as a risk provider to Aave are relatively capped ($2mm annually), whereas in $Morpho they can take a fee based on the success of the vault. Gauntlet's partnership with $Morpho underscores what could be a significant change in the DeFi lending protocol landscape. The ascent of protocols like $Morpho, Spark and Ajna brings a new wave of competition for protocols like Compound and Aave in what previously felt like a very “decided'' category.

Mike Neuder and Tarun Chitra explore risks of LRTs

📰 Story: The Total Value Locked (TVL) in Liquid Restaking Tokens (LRTs) has surged dramatically, soaring from $250 million to over $4 billion in just two months, primarily driven by EigenLayer's growth. This influx, largely speculative in anticipation of future yields from active restaking and early utilization of LRT protocols, has prompted an in-depth analysis of the risks inherent in LRTs. @mikeneuder from the Ethereum Foundation and @tarunchitra of Gauntlet have recently delved into these risks. Their analysis aims to enhance the understanding of LRTs by juxtaposing them with TradFi assets. It emphasizes that there is no such thing as a free lunch in finance – the promise of higher rewards with LRTs is invariably accompanied by greater risks.

💡 Our Take: The explosive growth of LRTs is a double-edged sword, presenting both opportunities and risks within DeFi. Neuder and Chitra's analysis suggests parallels between LRTs and early, volatile, high-growth financial products. As LRTs evolve, they could lead to more sophisticated financial products in DeFi, mirroring the evolution seen in traditional markets. The key lies in balancing innovation with risk, ensuring that the pursuit of higher yields does not overshadow the need for sustainability.

The 90-day increase in TVL on @ether_fi, a liquid restaking protocol, as tracked on @vaultsfyi.

GFX’s partnership with Uniswap goes live

📰 Story: In a significant step towards embracing new Layer 2 solutions, @Uniswap's community passed a notable governance proposal on February 28. The proposal, detailed on Uniswap's forum, involves a strategic partnership with @labsGFX. Known for developing @okutrade, a professional trading interface for Uniswap, GFX will now aid Uniswap's expansion into new Layer 2 ecosystems. This collaboration, underlining Uniswap's aggressive approach towards Layer 2 innovation, involves a funding of $315,000 over one year to support GFX’s contributions to this ambitious venture.

💡 Our Take: “B2DAO” is the key theme of this governance proposal. GFX has a long history with Uniswap and this proposal furthers the relationship of the two in a mutually beneficial way. Uniswap will get faster and more aggressive deployments on new chains and OKU (GFX) will be paid for those new deployments. DAOs (Uniswap, Maker, and many others) are some of the richest organizations in our industry and though navigating them can be difficult, the size of commercial agreements for companies can be extremely lucrative.

Head to the @wallfacerlabs website to check out our podcast episode with @getty_hill, co-founder of GFX Labs.

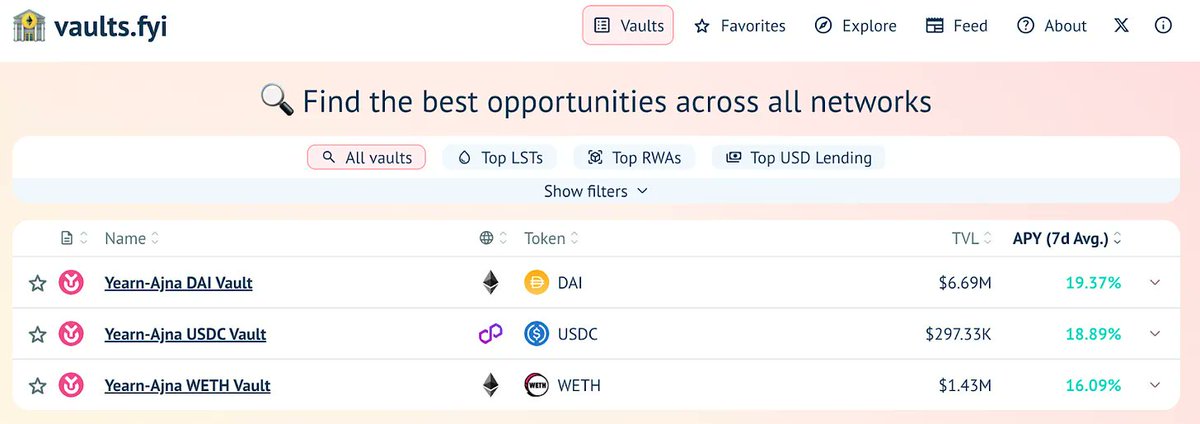

Yearn x Ajna’s juiced vaults now on @vaultsfyi

📰 Story: We recently added @yearnfi x @ajnafi's $ETH, $DAI, and $USDC juiced vaults to @vaultsfyi. These vaults, employing an innovative approach by auto-compounding $AJNA rewards, have shown exceptional performance with yields close to 20% APY over the last 7 days.

💡 Our Take: The success of Yearn and Ajna’s juiced vaults illustrates a broader trend: the continued diversification of DeFi opportunities. Ajna adds another layer of competition to DeFi by eschewing traditional oracles and governance for a market-driven, internal order book approach. Our ambition in developing @vaultsfyi was to craft a competitive arena where the most effective yield strategies naturally rise to the top.

7-day APY averages for Yearn/Ajna’s juiced vaults on ike.