Wallfacer Weekly (#9)

Welcome back to our weekly newsletter!

Wallfacer Labs launches API for vaultsfyi

📰 Story: We are excited to announce the launch of the @vaultsfyi API, a new resource for accessing comprehensive onchain data directly from DeFi vaults. The release of the API represents a crucial step towards fulfilling our commitment to transparency and accessibility in DeFi. For an overview of what you can achieve with this powerful tool, check out the API documentation.

💡 Our Take: When we started building @vaultsfyi, our goal was to provide the DeFi community with standardized, reliable data directly sourced from the blockchain, bypassing external APIs. We're now excited to release our API to the public, designed for app developers, analysts, and DeFi enthusiasts. We value the insights of our power users, whose feedback and questions are vital for maximizing the potential of this API, and we are eager to support your projects!

USDP price spike triggers Aave liquidations

📰 Story: Earlier this week, the price of the $USDP stablecoin spiked to >$1.50 on Binance. As $USDP is a borrowable asset on Aave v2 on Ethereum, this led to $2.4M in liquidations with a single user having $1M of $USDC collateral seized. The protocol only accured a small amount of bad debt at $1.36k. In response to the incident, @chaos_labs shared a governance proposal to reduce loan-to-value ratios for major stablecoins and to phase out smaller, non-collateral stablecoins such as $USDP.

The price of USDP, as seen on Binance.

💡 Our Take: This event comes the same week Avi Eisenberg was convicted for market manipulation in a similar attack on Mango Markets in 2022. We foresee this event prompting more drama in the lending space, where there has already been friction between Aave and Morpho. Newer lending protocols like Morpho, Ajna, and Euler rely less upon DAO governance for setting risk parameters and aim to mitigate attacks such as the one observed on $USDP.

Market volatility provides stress test for Ethena

📰 Story: This week, bitcoin's decline from above $70k to $60k, alongside a more pronounced drop in altcoins, tested the resilience of DeFi protocols. With many critics suggesting that Ethena can only thrive in a positive funding environment, a week of negative funding provided a stress test for the protocol. @leptokurtic_, Ethena's founder, highlighted that despite the deleveraging event, the protocol maintained a positive yield of +5.5%. Data from @vaultsfyi aligns with these insights, showing a decline in APY yet affirming the protocol's strength in sustaining positive yields through the volatility.

The 7-day decline in Ethena’s yield, as seen on @vaultsfyi.

💡 Our Take: Ethena's unique DeFi product, particularly USDe, has quickly gained traction with major players like MakerDAO, reshaping the DeFi landscape. This rapid adoption highlights the need for rigorous stress testing to confirm the protocol's robustness. Ethena's ability to manage recent market volatility with minimal impact is reassuring. However, despite its demonstrated resilience, it's prudent to maintain a cautious approach when evaluating Ethena's risk profile.

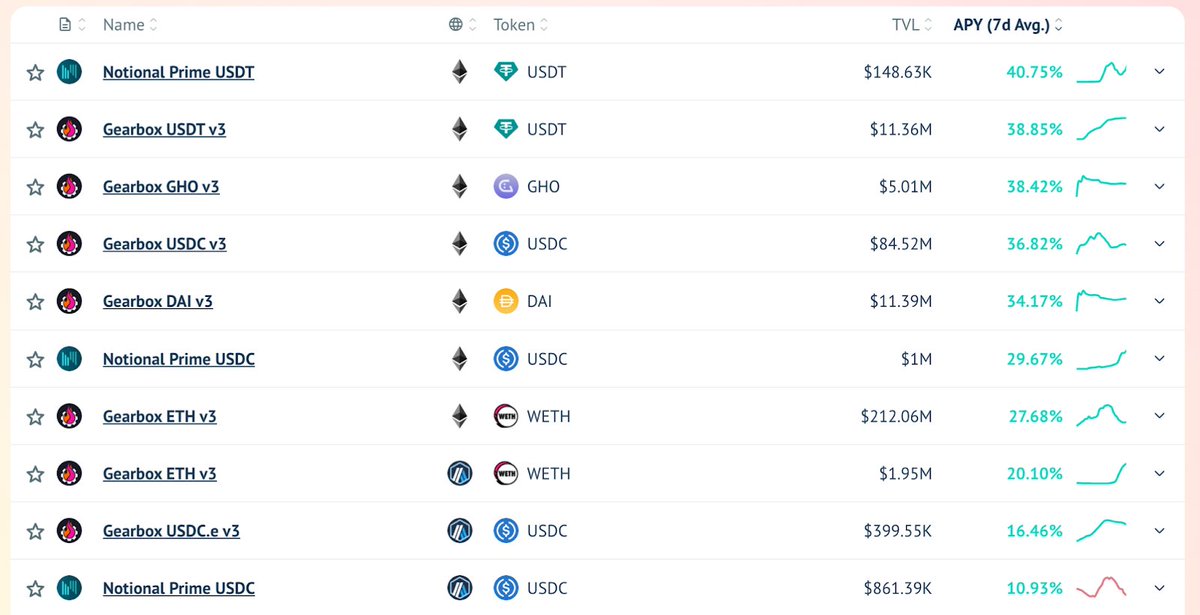

New protocols on vaultsfyi: Gearbox & Notional

📰 Story: This week we added @GearboxProtocol and @NotionalFinance as protocols to @vaultsfyi. These additions allow users to filter and analyze Gearbox and Notional vaults directly on our platform, providing deeper insights into their performance.

Gearbox and Notional’s top-performing vaults, as seen on @vaultsfyi.

💡 Our Take: We are always enthusiastic about incorporating up-and-coming protocols into @vaultsfyi, as this makes the DeFi space more competitive and gives users a wider range of options. While the total value locked (TVL) in newer protocols like Gearbox and Notional Finance may be lower, they compensate lenders with attractive APYs. Notably, Gearbox and Notional currently offer the highest stablecoin yields listed on @vaultsfyi, with numerous vaults comfortably over 30% APY.