Loading data, please wait a moment. We are fetching the latest content from the server and validating, organizing, and rendering it to ensure the information you see is accurate, complete, and up to date. Loading speed may be affected by your network, device performance, or the current amount of data, so a brief wait is normal. To avoid extra delays caused by duplicate requests, please don't refresh frequently or repeatedly click buttons, and don't close the page or switch to an offline network. The page will update automatically once the data is ready. If it takes noticeably longer, check your network connection and try refreshing or coming back later. If the issue persists, please let us know so we can investigate. Thanks for your patience and understanding.

Total MarketCap: $0 0

24H Vol: $0.00

BTC:

0 sat/vB

ETH: Gwei

Enable crypto investment for the global masses

Categories:

DeFi

Layer3

Derivatives

Options

Ecosystem:

Optimism

Arbitrum

Founded:

2021

Lyra is an automated market maker (AMM) for options, allowing traders to buy and sell options on cryptocurrencies from a pool of liquidity. Liquidity providers (LPs) deposit sUSD (a stablecoin) into one of the asset-specific Lyra Market Maker Vaults (MMVs). This liquidity is used to create two-way (buy and sell) options markets for the asset that the vault holds (e.g. ETH Market Maker Vault LPs quote options on ETH). LPs deposit liquidity into the vault to receive the fees paid when options are traded. Traders use Lyra to trade options, either buying options from or selling options to the MMV. They pay fees (in the form of the market-making spread) to LPs, as payment for their liquidity.

Derive Fundraising

Community

Amount

$1M

Valuation

--

Date

Dec 20, 2024

Amount

--

Valuation

--

Date

Sep 13, 2024

Amount

$4M

Valuation

--

Date

Jul 26, 2021

Investor

Derive Team

News

Scan QR Code to Explore more key information

Categories:

DeFi

Layer3

Derivatives

Options

Ecosystem:

Optimism

Arbitrum

Founded:

2021

Lyra is an automated market maker (AMM) for options, allowing traders to buy and sell options on cryptocurrencies from a pool of liquidity. Liquidity providers (LPs) deposit sUSD (a stablecoin) into one of the asset-specific Lyra Market Maker Vaults (MMVs). This liquidity is used to create two-way (buy and sell) options markets for the asset that the vault holds (e.g. ETH Market Maker Vault LPs quote options on ETH). LPs deposit liquidity into the vault to receive the fees paid when options are traded. Traders use Lyra to trade options, either buying options from or selling options to the MMV. They pay fees (in the form of the market-making spread) to LPs, as payment for their liquidity.

Derive Fundraising

Fundraising Event

| Round | Amount | Valuation | Date | Investors |

|---|---|---|---|---|

| Community | $1M | -- | Dec 20, 2024 | |

| -- | -- | -- | Sep 13, 2024 | |

| Strategic | $3M | -- | Nov 30, 2022 | |

| -- | $4M | -- | Jul 26, 2021 |

Investor

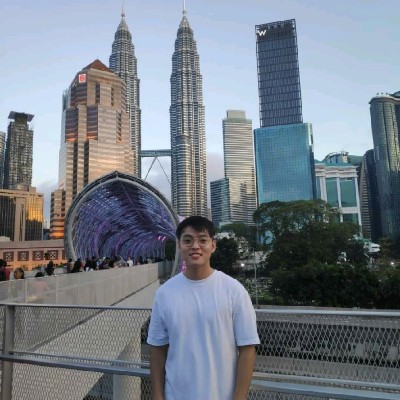

Derive Team

Powered by

News