Yield Basis

YB

Yield Basis Timeline

Yield Basis Token unlock

Yield Basis Token allocation

Yield Basis BasicReport a Data Error

Yield Basis Info

Yield Basis Intro

Yield Basis is an innovative decentralized finance (DeFi) protocol conceived by Curve Finance founder Michael Egorov, aiming to solve one of the most significant challenges facing automated market makers (AMMs): impermanent loss. This phenomenon, which can erode the gains of liquidity providers (LPs), is fundamentally addressed by Yield Basis through a novel design centered on its utilization of the crvUSD stablecoin. By mitigating the risk of impermanent loss, the protocol strives to offer a more secure and predictable environment for users who contribute liquidity, thereby encouraging deeper and more resilient pools for key assets.

The core mechanism of Yield Basis involves employing strategic financial engineering, specifically 2x leverage via crvUSD, to optimize liquidity positions. This leveraging is intended to enhance the capital efficiency of the pooled assets, offering the potential for increased yields for holders of major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Importantly, the protocol is designed with an eye toward long-term sustainability, ensuring that the boosted returns are achieved through a balanced and robust economic model, rather than speculative or high-risk strategies. This focus on optimized capital utilization makes it a compelling proposition for users seeking competitive, yet sustainable, returns on their crypto holdings.

Liquidity contributions within the Yield Basis ecosystem are tokenized, transforming the underlying assets into yield-bearing tokens such as ybBTC and ybETH. This tokenization standardizes the liquidity position, making it easily transferable and composable within the wider DeFi landscape. Crucially, these new yield-bearing assets unlock a secondary utility: they can be staked to earn additional rewards, further compounding the potential returns for LPs. This multi-layered reward structure and the composability of the yield-bearing tokens position Yield Basis as a forward-thinking protocol designed to maximize utility and reward for liquidity providers in the DeFi space.

Yield Basis Unlock & AllocationReport a Data Error

Yield Basis Timeline

Yield Basis Token unlock

Yield Basis Token allocation

Q&A about Yield Basis Tokenomics

Explore the tokenomics of Yield Basis(YB) and review the project details below.

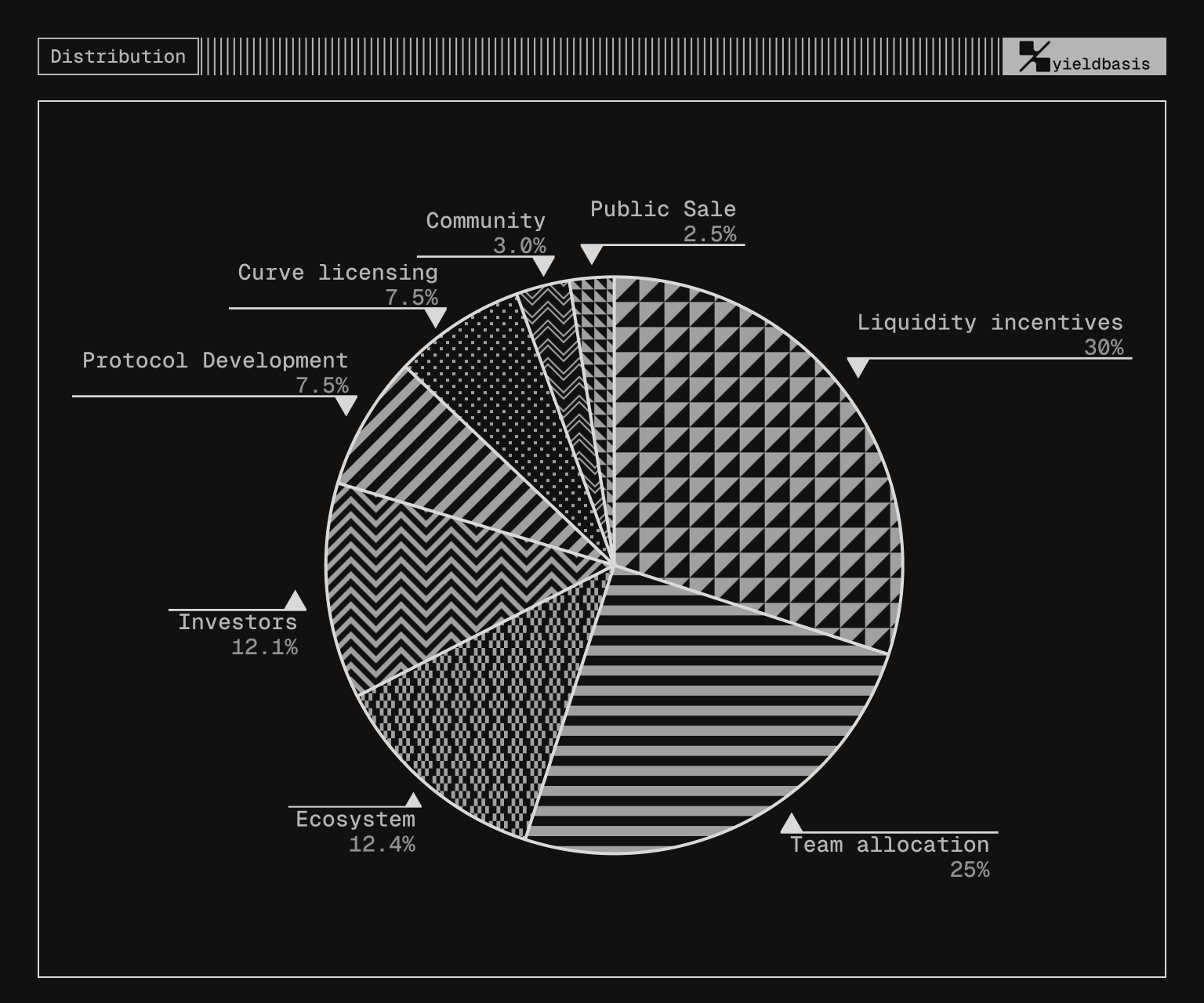

What is the allocation for Yield Basis(YB)?

The total $YB supply (fully diluted) amounts to 1 billion (1,000,000,000) tokens.

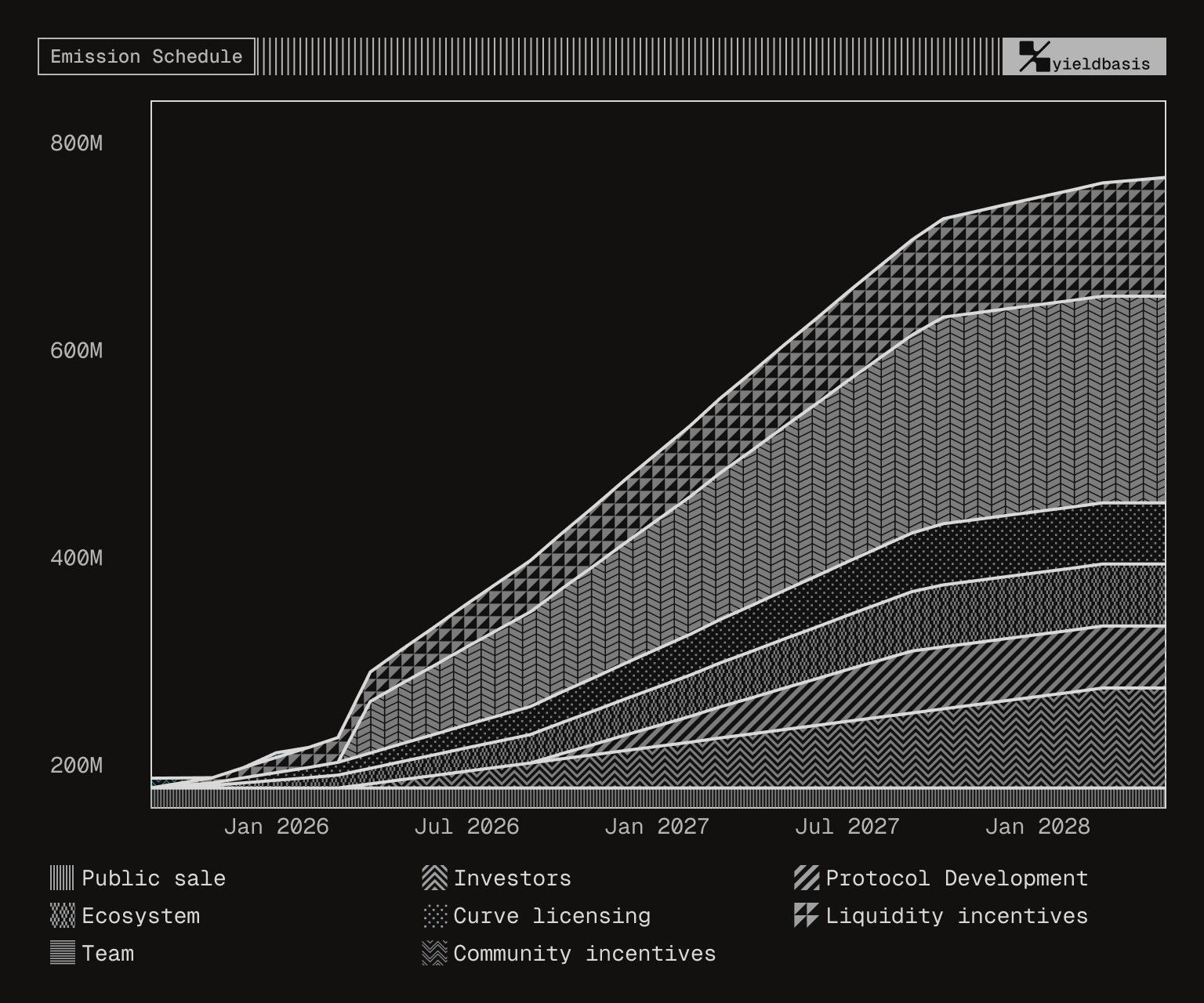

What is the supply schedule for Yield Basis(YB)?

Public Sale: Fully unlocked from day one

Team: 2 years vesting with 6-month cliff

Ecosystem Reserve: 50M at TGE + 2 years linear vesting

Liquidity Incentives: Dynamic schedule for ongoing emissions

Protocol Development Reserve: 1-year linear vesting starting 1 year after TGE

Curve Licensing: 2-year linear vesting

Curve Governance: Immediately unlocked

Early LPs Season 1: 12 months linear vesting (starts immediately)

Early LPs Season 2: 12 months linear vesting (starts 3 months after TGE)

YB Pair Rewards: 1 year linear vesting

Initial YB DEX Liquidity: Fully unlocked from day one