Plasma

XPL

Plasma Timeline

Plasma Token unlock

Plasma Token allocation

Plasma BasicReport a Data Error

Plasma Info

Plasma Intro

Plasma is a high-performance, scalable, and secure blockchain purpose-built for stablecoins. Traditional blockchains were designed long before stablecoins existed or gained traction. Today, stablecoins have over $225 billion in supply and see trillions of dollars transferred monthly, making them one of crypto’s most critical use cases. However, current blockchains face significant obstacles for stablecoins, such as high transaction fees, centralization issues, high transaction failure rates, and a lack of specialized features required to support stablecoins from first principles.

With backing from Bitfinex/USDT0, Plasma is engineered from the ground up to meet the unique needs of stablecoins. Our team brings together expertise in software engineering at Apple and Microsoft, high-frequency trading at Goldman Sachs, distributed systems research at Imperial College London and Los Alamos National Lab, and hands-on experience building some of the largest stablecoins and blockchains.

Plasma Unlock & AllocationReport a Data Error

Plasma Timeline

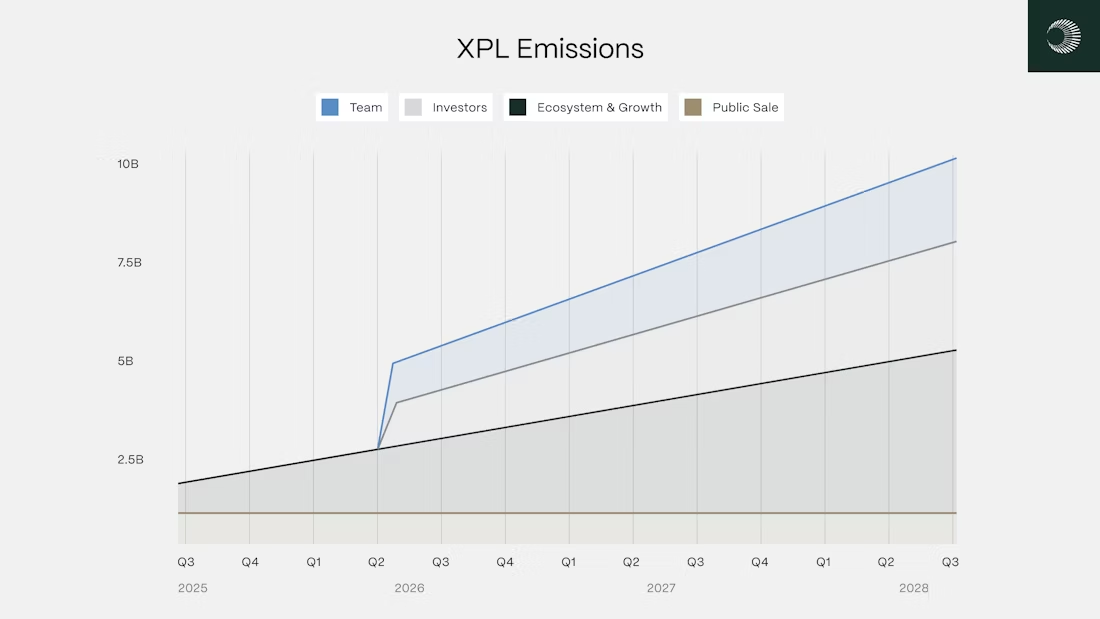

Plasma Token unlock

Plasma Token allocation

Q&A about Plasma Tokenomics

Explore the tokenomics of Plasma(XPL) and review the project details below.

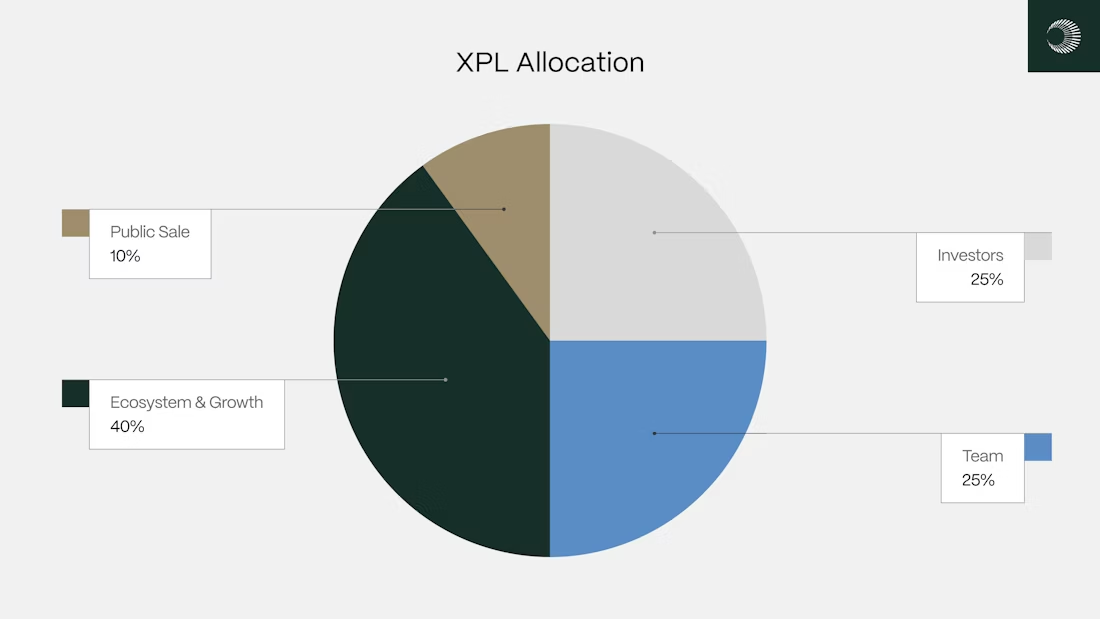

What is the allocation for Plasma(XPL)?

The initial supply will be 10,000,000,000 XPL at mainnet beta launch, with programmatic increases further described in the “Validator Network” section below.

XPL Public Sale: 10% (1,000,000,000 XPL)

We want to redefine how money moves with you, so earlier this year, we announced the XPL public sale, where 10% of the XPL supply (1,000,000,000 XPL) was allocated to participants in the deposit campaign. XPL sold in the public sale are unlocked as follows:

•XPL purchased by non-US purchasers are fully unlocked upon launch of the Plasma Mainnet Beta.

•XPL purchased by US purchasers are subject to a 12-month lockup and will be fully unlocked on July 28, 2026.

Ecosystem and Growth: 40% (4,000,000,000 XPL)

Plasma has an opportunity to rewrite existing financial systems, but it’s admittedly a capital-intensive endeavor. We plan to leverage XPL to intensify Plasma’s network effects, not just in crypto-native ecosystems, but across traditional finance and capital markets as well. While nobody has quite solved the riddle of network adoption, we believe that our streamlined approach in responsibly deploying XPL will contribute to widespread network effects that most crypto-native projects have failed to sustain over the long term. The XPL reserved for Ecosystem and Growth are unlocked as follows:

•40% of the XPL supply (4,000,000,000 XPL) is allocated to strategic growth initiatives that are designed to expand the utility, liquidity, and institutional adoption of the Plasma network.

•8% of the XPL supply (800,000,000 XPL) will be immediately unlocked at Plasma’s mainnet beta launch to provide for certain DeFi incentives with strategic launch partners, liquidity needs, support exchange integrations, and to implement early ecosystem growth campaigns.

•The remaining 32% (3,200,000,000 XPL) unlocks monthly on a pro-rata basis over the following three-year period, such that 100% of the Ecosystem and Growth allocation is unlocked on the date that is three years from the launch of the public mainnet beta.

Team: 25% (2,500,000,000 XPL)

Rewriting legacy financial systems requires industry-leading talent and attracting that talent requires long-term incentive alignment. As such, we’ve allocated 25% of the XPL supply (2,500,000,000 XPL) to incentivize current and future service providers. In addition to vesting schedules tied to start dates, the XPL allocated to the team are unlocked as follows:

•One-third of the XPL team tokens are subject to a one-year cliff from the date of the public launch of Plasma mainnet beta.

•The remaining two-thirds are unlocked monthly on a pro-rata basis over the following two-year period, such that 100% are unlocked on the date that is three years from the date of the public launch of Plasma mainnet beta.

Investors: 25% (2,500,000,000 XPL)

In order to build a blockchain infrastructure that will underwrite our mission to rewrite financial legacy systems, we needed to raise capital from the world’s leading investors. As such, Plasma received investments from high-caliber investors such as Founder’s Fund, Framework, and Bitfinex, among others, to support the development of the Plasma blockchain. In addition to high-caliber investors, Plasma has also pushed a community-aligned approach from day 1 with the first Echo sale to private investors in the seed round. XPL sold to investors are unlocked on the same schedule as the team allocation.

What is the supply schedule for Plasma(XPL)?