Treehouse

TREE

Treehouse Timeline

Treehouse Token unlock

Treehouse Token allocation

Treehouse BasicReport a Data Error

Treehouse Info

Treehouse Team

Treehouse Intro

Treehouse is a decentralized application pioneering fixed income infrastructure in crypto through two key innovations: Decentralized Offered Rates (DOR) and Treehouse Assets (tAssets). These primitives enable the creation of products like fixed-rate loans, swaps, and forward rate agreements—solutions that have long existed in traditional finance but remain largely absent in DeFi due to the lack of a standardized benchmark rate.

By depositing ETH or liquid staking tokens (LSTs) into the protocol, users receive tETH—an LST wrapper that helps stabilize on-chain borrowing rates and aligns them with ETH staking yields. This not only enhances rate consistency across DeFi but also contributes to the cryptoeconomic security of DOR, a rate-setting mechanism where panelists submit forward-looking rate expectations and stake their credibility on accuracy.

The TREE token underpins the entire ecosystem, serving as the utility and governance token that coordinates incentives among users, panelists, delegators, and developers. Through staking, governance, and fee routing, TREE helps secure the protocol and drive ecosystem growth. Altogether, Treehouse offers a scalable foundation for a decentralized fixed income market, addressing the volatility and fragmentation of today’s floating-rate protocols.

Treehouse Unlock & AllocationReport a Data Error

Treehouse Timeline

Treehouse Token unlock

Treehouse Token allocation

Q&A about Treehouse Tokenomics

Explore the tokenomics ofTreehouse(TREE) and review the project details below.

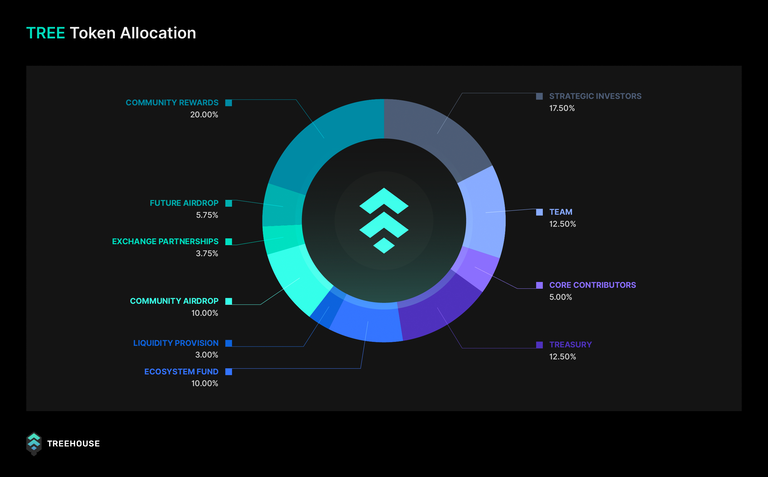

What is the allocation forTreehouse(TREE)?

TREE is allocated to various ecosystem stakeholders and incentive programs to ensure sustainable protocol growth and aligned participation.

- Community Rewards (20%): 20% of TREE is allocated to incentivize long-term alignment among Treehouse users. These rewards are distributed to participants who stake, govern, or actively engage with protocol activities.

- Strategic Investors (17.5%): Allocated to early backers and strategic partners who provided the financial and infrastructural support necessary to bootstrap Treehouse’s development. Their ongoing involvement helps accelerate product rollout, liquidity provisioning, and institutional adoption. All tokens in this category follow a vesting schedule to ensure long-term alignment.

- Team (12.5%): This allocation compensates the core team responsible for building the foundational architecture of Treehouse and its early products. Tokens are subject to a multi-year vesting schedule to incentivize continued commitment and protocol stewardship.

- Treasury (12.5%): The DAO-controlled treasury receives 12.5% of the TREE supply. These tokens are earmarked for future ecosystem needs, including protocol upgrades, partnerships, and liquidity support. Treasury usage is governed through on-chain voting and serves as a reserve for long-term protocol sustainability.

- Community Airdrop (10%): One-time distribution of TREE to early contributors, testers, and protocol participants to democratize ownership. This airdrop recognizes the grassroots efforts of Treehouse’s early believers and sets the stage for broader community governance participation.

- Ecosystem Fund (10%): A long-term fund dedicated to builders, developers, and ecosystem partners who expand the DOR standard and Treehouse product suite. The Ecosystem Fund supports grants, integrations, hackathons, and new on-chain products that leverage Treehouse infrastructure.

- Core Contributors (5%): Allocated to individuals and entities who played a critical role in protocol design, research, or infrastructure development. This allocation is governed separately from the Team allocation and focuses on long-term contributors beyond the core team.

- Exchange Partnerships (3.75%): Tokens reserved for the exchanges to bootstrap community interest, and cultivate alignment between the Treehouse and their ecosystems. This allocation supports awareness, accessibility, and early liquidity.

- Future Airdrops (5.75%): Reserved for post-launch growth campaigns, protocol expansions, and strategic community-building efforts. This allocation enables flexibility to reward participation and drive adoption beyond the initial airdrop phase.

- Liquidity Provision (3%): Allocated to seed on-chain liquidity pools and ensure sufficient depth for TREE across key trading venues. These tokens are used to reduce slippage, maintain stable price discovery, and support early token utility.