Syndicate

SYND

Syndicate Timeline

Syndicate Token unlock

Syndicate Token allocation

Syndicate BasicReport a Data Error

Syndicate Info

Syndicate Team

Syndicate Intro

Syndicate allows developers to build custom, application-specific blockchains (appchains) with programmable onchain sequencers fully owned and governed by their communities. Unlike general-purpose chains that share blockspace, Syndicate gives developers complete control over their network, transaction rules, and economic systems, enabling value to flow directly back to tokenized communities. It supports rollup frameworks like Arbitrum Orbit and plans to expand to OP Stack and non-EVM environments, offering maximum flexibility for appchain design and settlement.

Syndicate appchains combine three layers — execution, onchain sequencing, and settlement — to deliver scalability, control, and composability. Developers can customize transaction ordering, embed core protocols such as oracles and marketplaces directly into sequencers, and achieve atomic composability across chains, all while cutting costs by moving operations fully onchain.

The native token, SYND, is an ERC-20 asset with a fixed supply of 1 billion. Serving as both the gas and staking token, it powers transactions, secures the network, and aligns incentives among developers, users, and stakeholders, creating a unified economic foundation for the Syndicate ecosystem.

Syndicate Unlock & AllocationReport a Data Error

Syndicate Timeline

Syndicate Token unlock

Syndicate Token allocation

Q&A about Syndicate Tokenomics

Explore the tokenomics of Syndicate(SYND) and review the project details below.

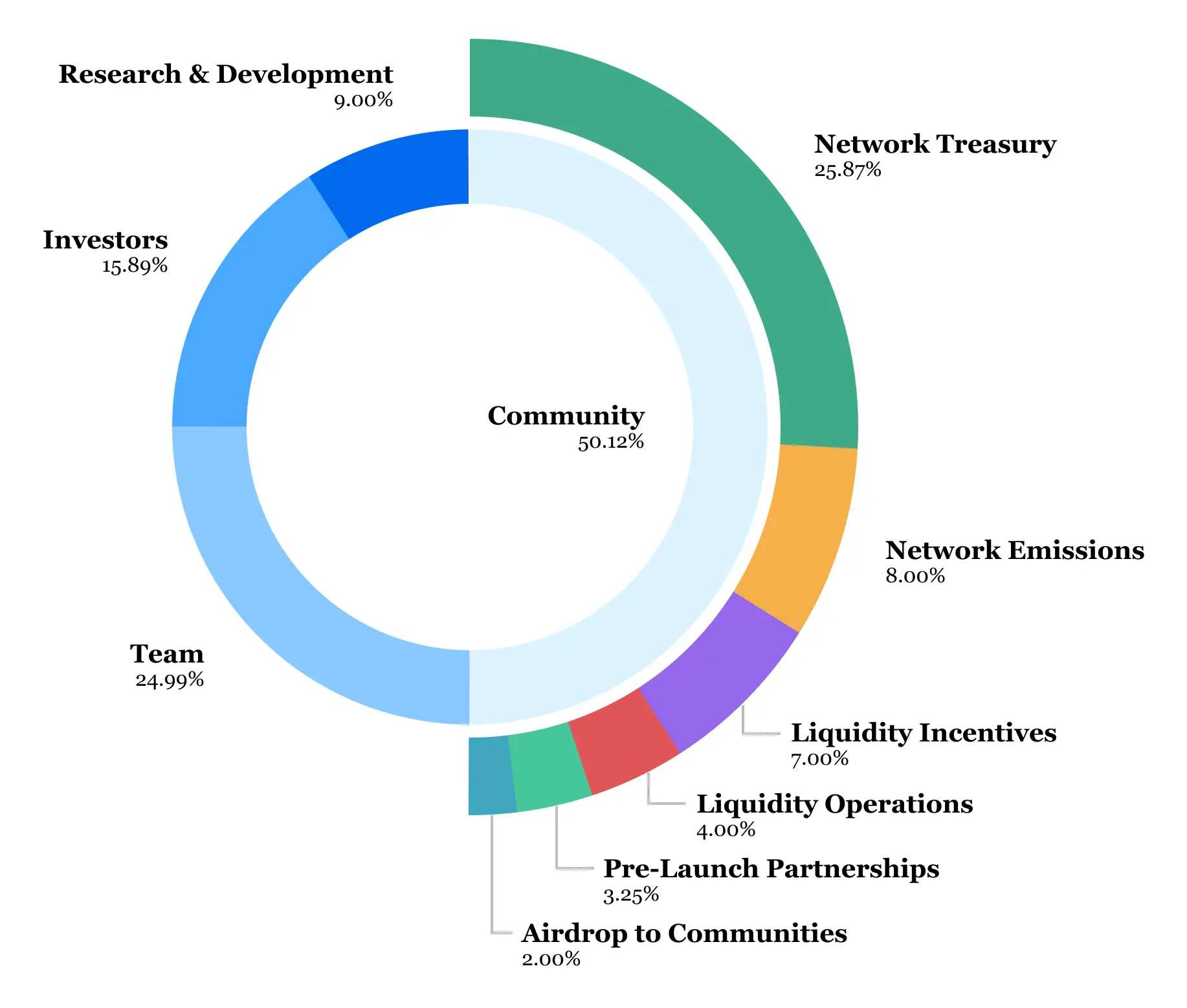

What is the allocation for Syndicate(SYND)?

SYND has a fixed total supply of 1,000,000,000 tokens. The allocation prioritizes community ownership (50.12% of supply) while supporting long-term development and growth.

1. Community — 501,200,000 SYND (50.12%):The largest portion of the supply, allocated across seven key areas to support ecosystem growth and future network needs.

- Treasury — 258,700,000 SYND (25.87%):Controlled by SYND token holders via the Syndicate Network Collective (a Wyoming DUNA). Tokens are unlocked at launch and used to fund network growth.

- Network Emissions — 80,000,000 SYND (8.00%):Emitted every 30 days over 4 years to support network expansion and participation. A three-pool incentive system rewards staking, supports promising appchains, and incentivizes appchain activity.

- Liquidity Incentives — 70,000,000 SYND (7.00%):Allocated for incentivized liquidity pools on Base (Aerodrome) during and after launch to establish and sustain market liquidity.

- Liquidity Operations — 40,000,000 SYND (4.00%):Reserved for ongoing liquidity management to ensure healthy markets and token accessibility.

- Pre-Launch Partnerships — 32,500,000 SYND (3.25%):Granted to key pre-launch partners who supported the network’s launch. Subject to milestone-based vesting.

- Airdrop — 20,000,000 SYND (2.00%):Distributed on August 15, 2025, to 107 addresses. Aimed at attracting appchains, users, and developers. Tokens are non-transferable until the public launch.

2. Team — 249,900,000 SYND (24.99%):Allocated to current and past Syndicate Labs contributors. Subject to a 48-month vesting schedule with a 12-month cliff.

3. Investors — 158,900,000 SYND (15.89%):Granted to early investors who supported Syndicate’s development. Subject to a 48-month vesting schedule with a 12-month cliff.

4. Research & Development — 90,000,000 SYND (9.00%):Dedicated to long-term R&D initiatives by Syndicate Labs to decentralize, innovate, and expand the network.

What is the supply schedule for Syndicate(SYND)?

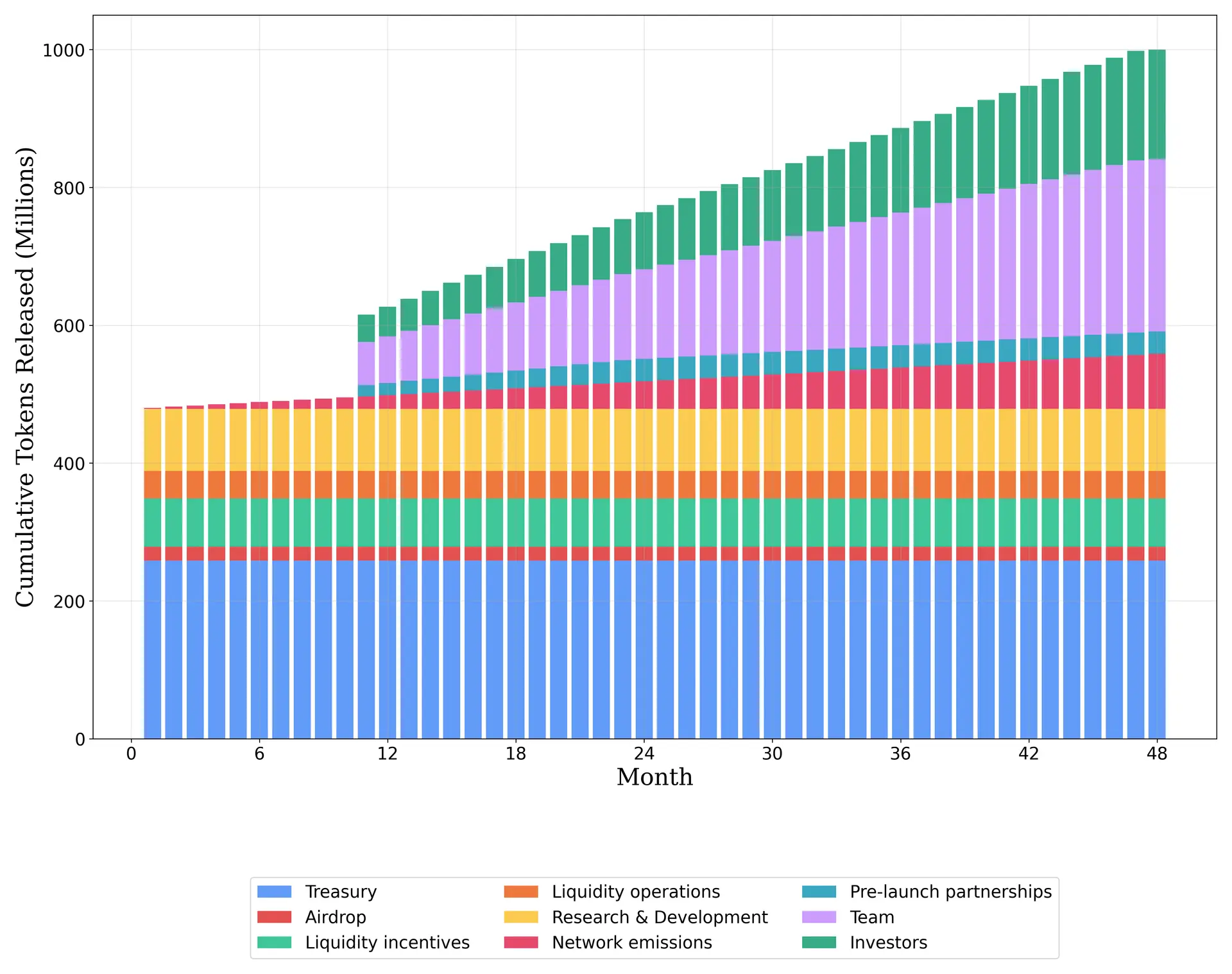

The following chart illustrates the cumulative token release schedule across all allocation categories over the 4-year emission period.

Network emissions distribute 80,000,000 SYND (8% of total supply) over 48 thirty-day epochs. The network currently operates with equal emissions per epoch to ensure predictable token distribution, though the emission formula supports flexible decay factors for future governance adjustments.