Linea

LINEA

Linea Timeline

Linea Token unlock

Linea Token allocation

Linea BasicReport a Data Error

Linea Info

Linea Intro

Linea is an Ethereum Layer 2 (L2) network built to enhance the scalability and efficiency of the Ethereum blockchain. Developed by Consensys, the company behind popular Web3 tools like MetaMask and Infura, Linea uses zero-knowledge (zk) rollup technology to process transactions off-chain. This approach dramatically increases transaction throughput and significantly lowers gas fees compared to the Ethereum mainnet, making decentralized applications (dApps) more accessible and affordable for both developers and users. Linea is designed as an "extension" of Ethereum, maintaining the foundational network's security and core values while overcoming its limitations.

A core feature that distinguishes Linea is its full EVM-equivalence, which ensures maximum compatibility with Ethereum. Developers can easily migrate existing smart contracts and dApps from Ethereum to Linea without needing to rewrite any code. This seamless integration with familiar developer tools and infrastructure, including MetaMask, Truffle, and Hardhat, provides a user-friendly experience and significantly reduces the barrier to entry for building on the network. This EVM-equivalence is a key factor in attracting a broad range of projects, from DeFi protocols to NFT marketplaces, into the Linea ecosystem.

Furthermore, Linea has established an innovative economic model that aligns its success with Ethereum's own growth. The network uses ETH as its native gas token, reinforcing Ethereum's value. A portion of the network's transaction fees is used to burn both ETH and the native LINEA token, creating a deflationary mechanism that ties network activity to value accrual for both assets. This, combined with a large ecosystem fund managed by an Ethereum-native consortium, directs resources toward rewarding network users and funding long-term Ethereum public goods, solidifying Linea's commitment to strengthening the broader Ethereum ecosystem.

Linea Unlock & AllocationReport a Data Error

Linea Token unlock

Linea Token allocation

Q&A about Linea Tokenomics

Explore the tokenomics of Linea(LINEA) and review the project details below.

What is the allocation for Linea(LINEA)?

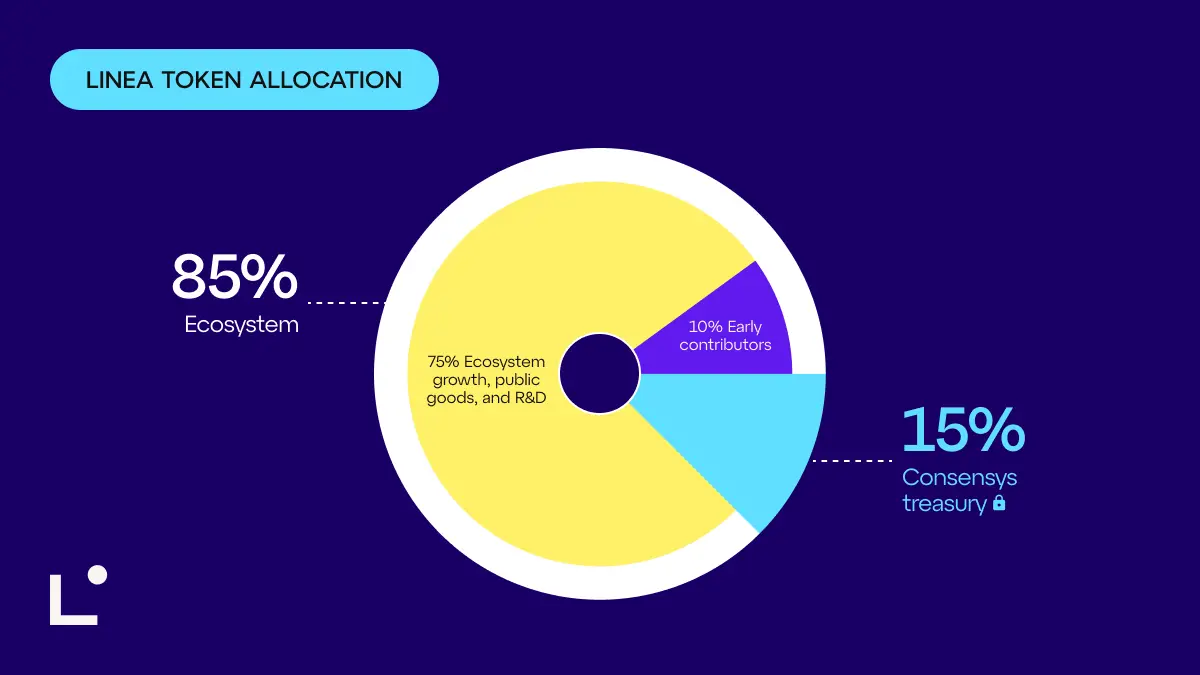

Linea’s total token supply is 72,009,990,000 LINEA, which is 1,000 times the initial circulating supply of ETH. Its allocation echoes Ethereum’s genesis distribution to signal long-term alignment with the broader ecosystem: 85% of the supply is dedicated to the ecosystem, with the remaining 15% allocated to the Consensys treasury. See below for a more detailed breakdown.

Early Contributors (10%)

Early users receive tokens from an allocation equal to 9% of token supply, to be airdropped and fully unlocked at TGE.

Eligibility for all airdrop recipients will be determined using a range of activity-based metrics, including LXP and onchain metrics designed to recognize authentic usage and meaningful ecosystem participation. Full details and individual eligibility will be revealed via the official eligibility checker, prior to TGE.

Alongside the user airdrop, 1% of the LINEA token supply is reserved for strategic builders across the Linea ecosystem, fully unlocked at TGE. This includes core applications and communities.

These tokens are not distributed by formula, but through a curated process that prioritizes long-term alignment, protocol-level impact, and sustained ecosystem participation. Allocations may be structured as direct grants, milestone-based vesting, or collaborative deployment with ecosystem partners.

Ecosystem Fund (75%)

75% of the LINEA token supply is allocated to the Ecosystem Fund, the largest such fund in the space. It is managed by the Linea Consortium: a council of Ethereum-native stewards including ENS Labs, Eigen Labs, SharpLink, Status, and Consensys. The Ecosystem Fund will live in a U.S.-based non-stock entity which will apply for non-profit status.

This fund is governed under an Ethereum-first mandate and deployed in two complementary phases:

1. Ecosystem Activation

A portion of the Ecosystem Fund is reserved for near-term ecosystem activation, including support for liquidity provisioning, exchange readiness, strategic partnerships, future airdrops, and early builder engagement.

2. Long-Term Alignment

The remaining majority of the fund supports long-term ecosystem growth and Ethereum public goods. It will be distributed over a 10-year period following a decaying emissions schedule, with more tokens available in the early years to accelerate adoption and fewer tokens over time to preserve sustainability. Roughly 25% of the Fund is expected to support ecosystem activation in the first 12–18 months, with the remaining 50% released gradually over 10 years. This capital will fund protocol R&D, shared infrastructure, open-source tools, and strategic partnerships with mission-aligned builders.

Consensys Treasury (15%)

15% of the total token supply is allocated to the Consensys treasury. These tokens are subject to a five-year lockup and are non-transferable until the full vesting cliff expires. During this period, they may be deployed within the ecosystem, for example, as liquidity or staking capital, to support protocol health and alignment.

This allocation reflects Consensys’ long-term commitment to Ethereum and its public infrastructure. As one of Ethereum’s earliest and most consistent contributors, Consensys has incubated Linea with the intent of reinforcing the Ethereum ecosystem. The locked treasury ensures that value accrual remains focused on community outcomes in the near term, while reserving a future role for Consensys as an aligned and accountable stakeholder over the long term.

People also watchReport a Data Error

Linea Price Live DataReport a Data Error