DeAgentAI

AIA

DeAgentAI Timeline

DeAgentAI Token allocation

DeAgentAI BasicReport a Data Error

DeAgentAI Info

DeAgentAI Intro

DeAgentAI is an AI agent infrastructure project designed to enable the creation, deployment, and coordination of autonomous agents in Web3. Its framework addresses three fundamental challenges for agents—Identity, Continuity, and Consensus—through modular components such as agent identity, memory, lifecycle management, consensus mechanisms, and tool integration.

The ecosystem includes both B2C and B2B products. AlphaX, the first live product, is an AI-driven crypto prediction engine that provides BTC/ETH short-term price trend signals with over 70% accuracy. It has achieved more than 401K daily active users, 17M+ total users, and 192M+ on-chain transactions across Sui, BNB Chain, and opBNB. Upcoming products include CorrAI, a no-code quantitative strategy builder, and Truesights, an InfoFi platform that rewards accurate market insights and governance forecasting.

The native token AIA functions as the backbone of the ecosystem. It is used to access services, stake for rewards, participate in governance, and receive ecosystem incentives. A portion of project revenue is also allocated for token buyback and burn, supporting long-term value. Backed by leading investors such as Web3.com Ventures, SNZ Capital, KuCoin Ventures, Vertex Capital, Valkyrie Fund and Momentum, and integrated with partners including Binance Wallet, OKX Wallet, and Sui Network, DeAgentAI delivers a scalable, multi-chain AI agent framework with proven adoption.

DeAgentAI Unlock & AllocationReport a Data Error

Q&A about DeAgentAI Tokenomics

Explore the tokenomics of DeAgentAI(AIA) and review the project details below.

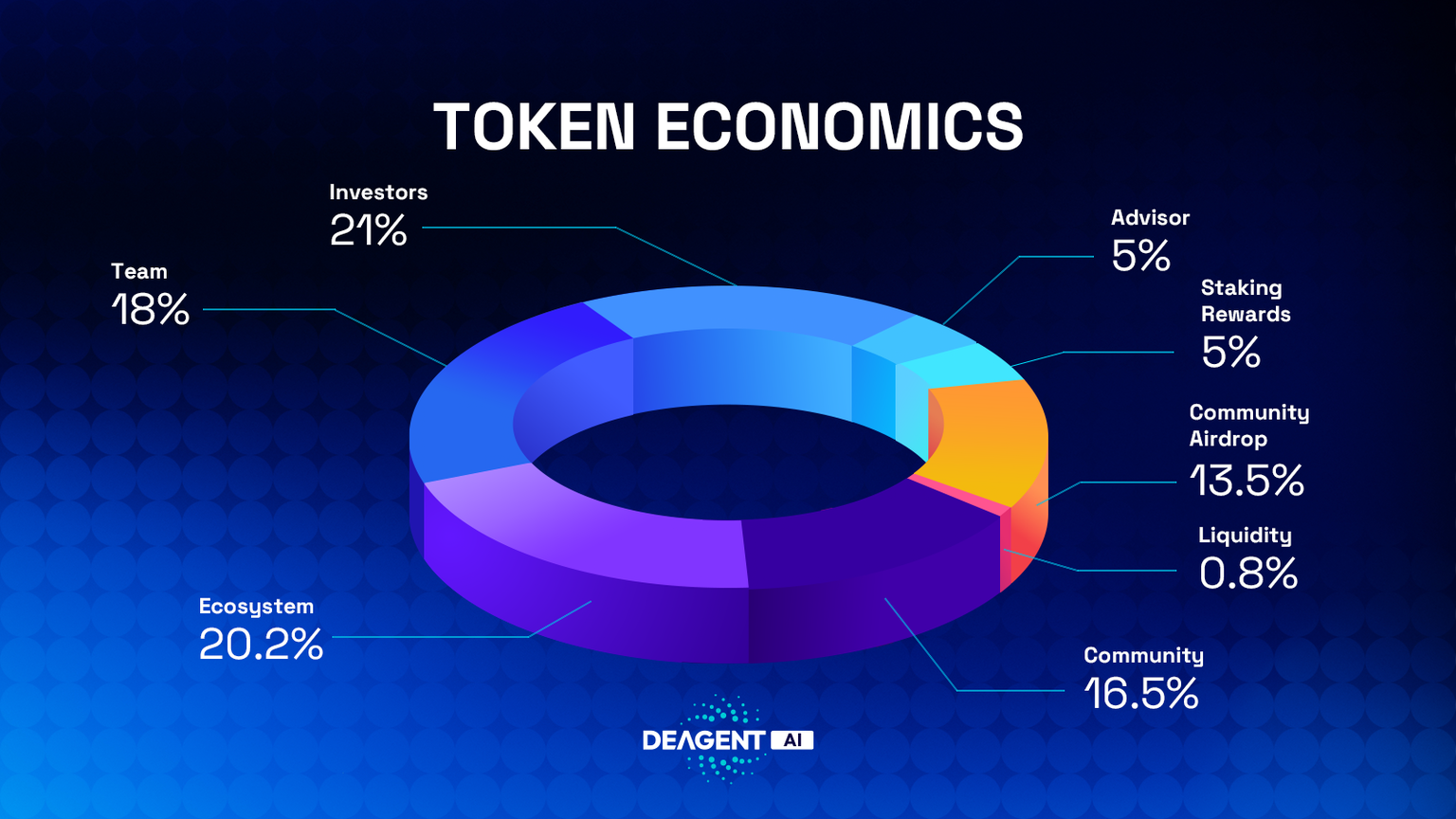

What is the allocation for DeAgentAI(AIA)?

The distribution model for DeAgentAI is designed to maximize community participation and ownership, ensuring the long-term, sustainable development of the ecosystem. 58.2% of the total supply is allocated to the community and ecosystem development.

- Token Name: DeAgentAI

- Ticker: $AIA

- Total Supply: 1,000,000,000 $AIA

- Initial Unlocked Supply: 9.95%

Investors(21.00%): To provide funding for the project's early-stage R&D and launch.

Ecosystem(20.20%): For strategic partnerships, developer incentives, project incubation, and ecosystem expansion.

Team(18.00%): To incentivize the long-term contribution of the core team, deeply aligning their interests with the project's success.

Community(16.50%): To incentivize community and product ecosystem development, expand brand influence, and drive user growth.

Community Airdrop(13.50%): To reward early users for our contributions to building the network.

Staking Rewards(5.00%): To encourage long-term holding and network participation, maintaining ecosystem stability.

Advisor(5.00%): For strategic guidance and resource support from industry experts.

Liquidity(0.80%): To ensure sufficient trading liquidity upon initial listing and maintain healthy market dynamics.

What is the supply schedule for DeAgentAI(AIA)?

Investors: 1-year cliff, followed by 3-year linear vesting.

Ecosystem: A portion unlocked at TGE for initial bootstrapping, with the core allocation subject to a long-term lockup, followed by a 3-year linear vesting period.

Team: 1-year cliff, followed by 3-year linear vesting.

Community: Released gradually based on community growth milestones and governance proposals.

Community Airdrop: Released programmatically in phases over a 2-year period.

Staking Rewards: Released programmatically in phases over a 1-year period.

Advisor: 1-year cliff, followed by 3-year linear vesting.

Liquidity: 100% unlocked at TGE.