What Are NFTs? Exploring the World of Digital Collectibles

What are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets stored on a blockchain. Unlike cryptocurrencies like Bitcoin, which are fungible (one Bitcoin is the same as another), NFTs are one-of-a-kind. Each NFT has a unique identifier that distinguishes it from any other token. They can't be swapped one-for-one because each NFT has its own value. NFTs are more than just pixelated cats and expensive JPGs. Think of them as digital certificates of ownership for anything from art to music, virtual real estate, and even tweets. NFTs can be bought, sold, and traded, often with the added benefit of royalties for creators. They’re reshaping industries, empowering creators, and creating new economies.

Key Takeaways

NFTs are unique digital assets that prove ownership of something in the digital world.

Unlike regular currency or Bitcoin, where every unit is the same (fungible), an NFT is one-of-a-kind.

They offer new ways for creators to monetize their work and for collectors to own rare digital items.

Common Use Cases of NFTs: Not Just for Art

NFTs are undeniably disrupting traditional industries—from art and gaming to music and real estate. But like any new technology, they’re still finding their place in the world. Let’s take a look at some common areas where NFTs are making waves.

Digital Art: NFTs have revolutionized the art world. Artists like Beeple and Pak have made millions by selling their work directly to collectors, bypassing traditional galleries.

Music: Musicians use NFTs to sell albums, concert tickets, and even royalty rights. Kings of Leon released their album as an NFT, offering perks like front-row seats for life.

Gaming: In games like Axie Infinity, players earn NFTs as in-game assets, which they can trade or sell. This "play-to-earn" model is creating new income streams for gamers worldwide.

Virtual Real Estate: Virtual real estate is blurring the lines between the physical and digital worlds. Platforms like Decentraland allow users to buy, sell, and develop virtual land like NFTs. A plot in Decentraland sold for $2.4 million in 2021.

NFT-Related Tokens:NFT-related tokens function as transactional units and incentive mechanisms that facilitate the engagement of NFT communities. According to data from SoSoValue, the following tokens are the top five by market capitalization among NFTs-related tokens: Pudgy Penguins (PENGU), ApeCoin (APE), APENFT (NFT), SuperVerse (SUPER), and Blur (BLUR).

Understanding Fungible Tokens

Fungible Tokens (FTs) are the lifeblood of most blockchain ecosystems. Think of them as currency in the digital world—like Bitcoin, Ether, or USDT. They are used for a variety of purposes, from serving as digital currency to powering smart contracts or decentralized finance applications.

The primary feature of fungible tokens is interchangeability. Each unit of a particular token holds the same value as every other unit. They can be traded or exchanged on a one-to-one basis because they are identical in value.

There are four main types of Fungible Tokens.:

Cryptocurrencies like Bitcoin and Ethereum are the most well-known fungible tokens, used as digital money for peer-to-peer transactions. They act as a store of value or medium of exchange.

A subset of these, stablecoins, maintain stable value by being pegged to a fiat currency, such as Tether (USDT), which is 1:1 with the US Dollar, and USD Coin (USDC), backed by US dollars and focused on transparency.

Utility Tokens, like Chainlink (LINK), are used within specific ecosystems to access services, such as paying for external data to execute smart contracts.

Governance Tokens, like Uniswap (UNI), allow holders to vote on protocol decisions and influence project direction.

Fungible tokens facilitate transactions, value storage, and governance within blockchain ecosystems. As you know, one Bitcoin is always the same as another. They’re perfect for transactions but lack uniqueness.

Key differences between NFTs and FTs

NFTs and FTs are both critical components of the evolving digital ecosystem, but they serve very different purposes. FTs are ideal for transactions, store-of-value purposes, and market liquidity, while NFTs shine in areas where unique ownership and digital scarcity are highly valued.

Quick Comparison:

Feature | Fungible Tokens (FTs) | Non-Fungible Tokens (NFTs) |

Interchangeability | Identical, can be traded 1:1 | Unique. Every NFT is one of a kind. |

Value | Constant, market-determined | Varies based on rarity, demand, and uniqueness |

Example | Bitcoin, Ethereum, USDT | CryptoPunks, Bored Ape Yacht Club, Beeple’s artwork |

Use Case | Currency, Investment | Digital Ownership, Collectibles, Gaming |

Emotional Attachment | Low. Most people don’t get emotionally attached to a specific coin or token. | High. NFTs can be deeply personal or valuable to their owners. |

Royalties | No Royalties. Once you sell or trade FTs, you’re done. No future royalties for the original creator. | Royalties for Creators. A unique feature of NFTs is the ability for creators to receive royalties every time their NFT changes hands. |

Famous NFT collections

NFTs have become a phenomenon in the digital world, and several groundbreaking sales and projects have captivated the public's attention. Here’s a deep dive into some of the most notable NFT sales.

1. The Most Expensive NFT Tweet: Jack Dorsey’s First Tweet

Price: $2.9 million

Platform: Valuables by Cent

Date: March 2021

Twitter co-founder Jack Dorsey auctioned his first tweet, "Just setting up my twttr," as an NFT. This sale highlighted the potential of NFTs to tokenize even the most ephemeral digital content.

2. The Most Expensive Short Video NFT: "Crossroads" by Beeple

Artist: Beeple

Sale Price: $6.6 million

Platform: Nifty Gateway

Date: February 2021

Before Beeple's world-record-breaking sale at Christie’s, his "Crossroads" NFT was sold on Nifty Gateway for $6.6 million in February 2021. This 10-second video changes based on the outcome of the 2020 U.S. presidential election. If Trump had won, the video would show him running through flames; instead, it depicts him lying defeated on the ground.

3. The Most Expensive CryptoPunk: CryptoPunk #7523

Price: $11.75 million

Auction House: Sotheby’s

Date: June 2021

CryptoPunks are among the earliest NFT projects, and #7523 stands out due to its rare "alien" attribute and mask design. Only 9 out of 10,000 CryptoPunks have this combination, making it a highly sought-after collectible.

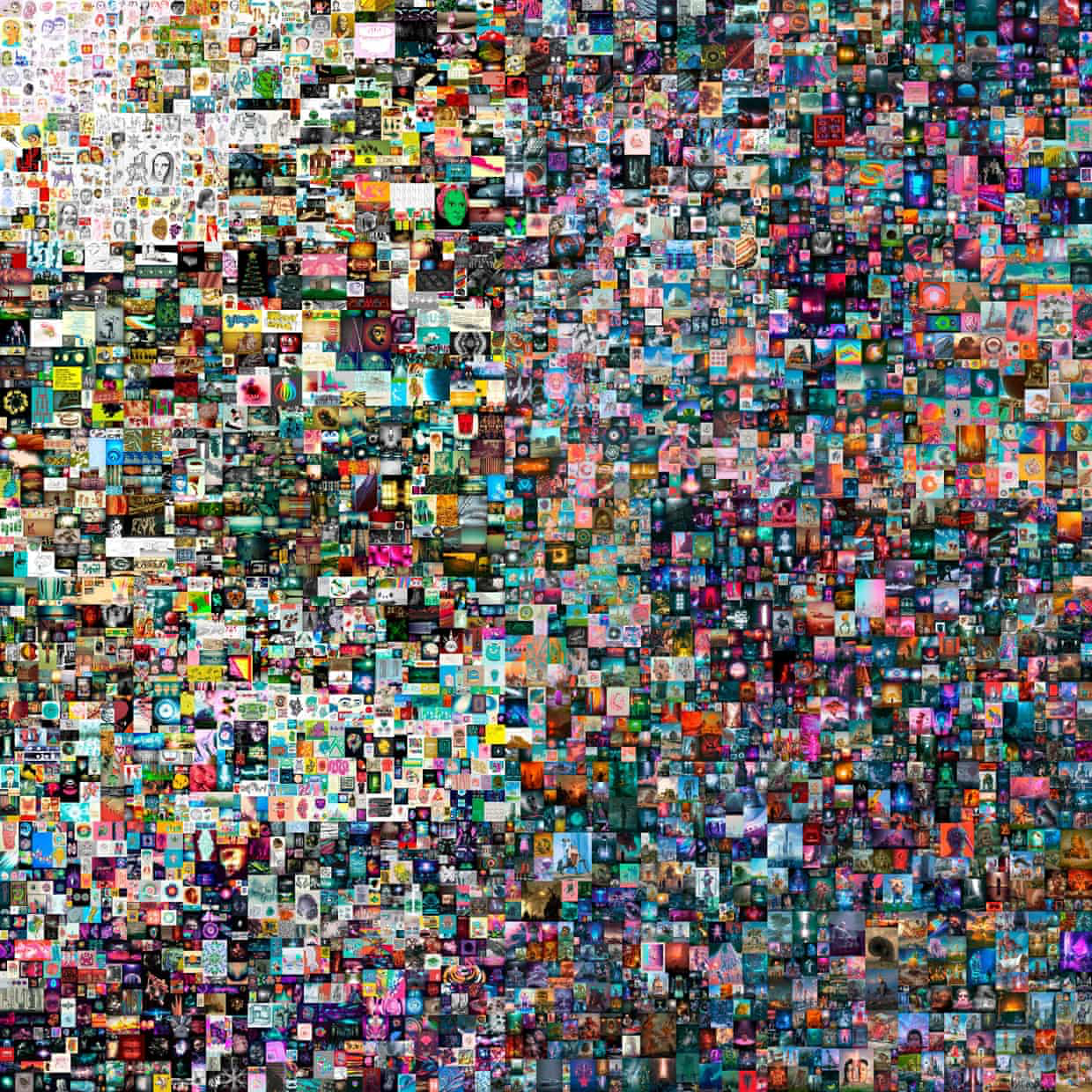

4. The Most Expensive NFT Artwork: "Everydays: The First 5000 Days" by Beeple

Artist: Beeple (Mike Winkelmann)

Sale Price: $69.3 million

Platform: Christie’s Auction House

Date: March 2021

The artwork is a collage of 5,000 images, created by Beeple over 13 years. Each image represents a day of his artistic journey, showcasing his evolution as a digital artist. The sale of Everydays: The First 5000 Days signaled a paradigm shift in the art market, legitimizing digital art as a valuable asset class.

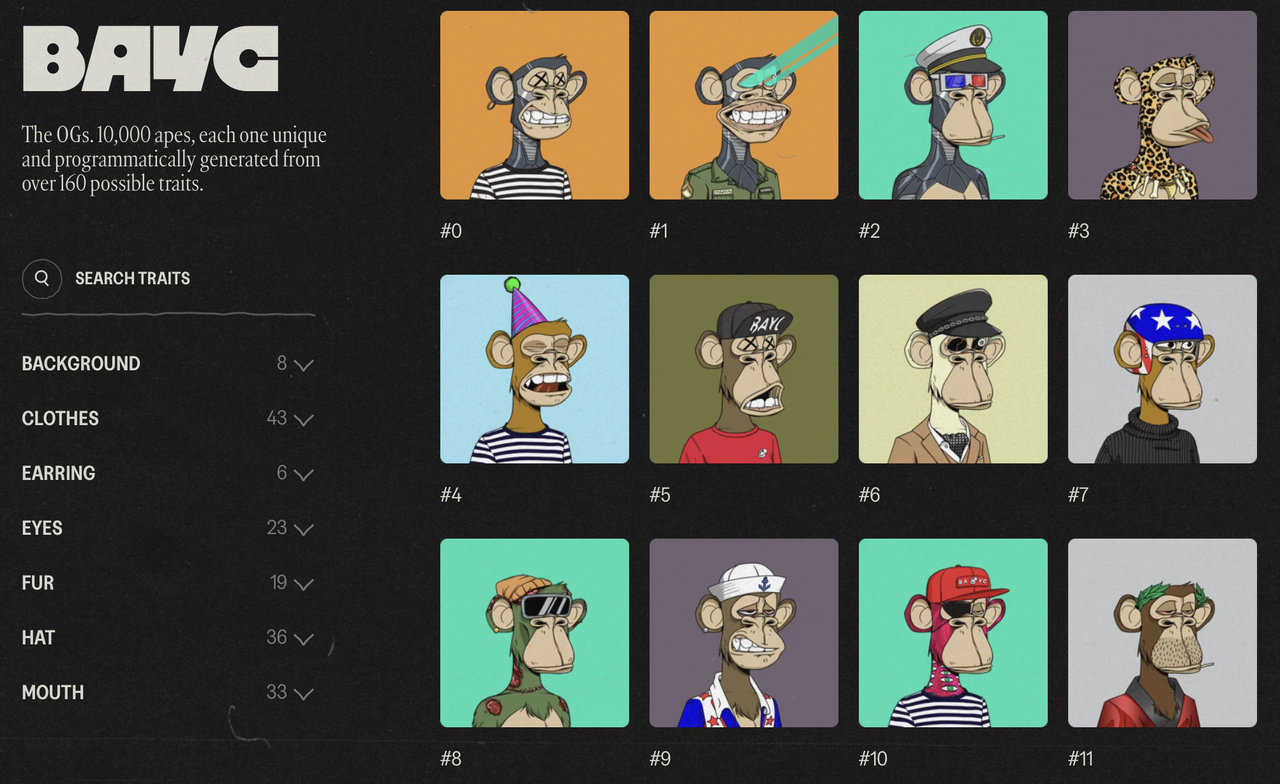

5. The Most Expensive NFT Collection: Bored Ape Yacht Club (BAYC)

Collection: Bored Ape Yacht Club (BAYC)

Price: Over $1 billion in total sales

Platform: OpenSea

Date: Ongoing (since April 2021)

The Bored Ape Yacht Club (BAYC) has become a cultural phenomenon. This NFT collection consists of 10,000 unique hand-drawn ape avatars, each with different traits, backgrounds, and accessories. In 2022, the total market value of BAYC passed $1 billion in sales, making it one of the most successful and expensive NFT collections in history. ApeCoin, the project’s token, has further boosted its ecosystem.

Regulatory Insights

Although NFTs have gained massive popularity, especially with high-profile sales and community-driven projects, their legal classification remains somewhat unclear. When it comes to regulation, NFTs don’t fit neatly into existing frameworks for financial assets like securities or commodities. The key questions surrounding NFTs involve whether they should be classified as securities or not. At the heart of the debate is the Howey Test, a legal standard used in the U.S. to determine whether an asset qualifies as a security. The test hinges on four criteria:

Investment of Money: Is there an investment in capital?

Common Enterprise: Is the investment pooled into a common enterprise?

Expectation of Profit: Do investors expect to profit from their investment?

Efforts of Others: Are profits derived from the efforts of a third party?

David Sacks, the White House AI and crypto czar, argues that NFTs—particularly those tied to digital art and collectibles—are unlikely to meet these criteria. According to Sacks, NFTs and memecoins are fundamentally different from traditional securities because they are not sold with the expectation of profit derived from the efforts of others. For example, owning a Bored Ape NFT doesn’t grant the holder a share in Yuga Labs’ profits; it simply provides access to a unique digital asset and community perks.

However, this distinction places NFTs in a regulatory gray area. While they may not be securities, their unique characteristics—such as fractional ownership and secondary market trading—have attracted scrutiny from regulators.

The U.S. Securities and Exchange Commission (SEC) has not classified NFTs as securities outright, but it has issued warnings that certain NFT projects could fall under securities laws if they involve investment contracts. For instance, the SEC has targeted projects like Impact Theory, which sold NFTs with promises of future profits, labeling them as unregistered securities.

Projects like ApeCoin, which launched its own token alongside the Bored Ape Yacht Club NFTs, are navigating this gray area carefully. While the NFTs themselves are seen as collectibles, the associated token (APE) blurs the line between utility and security, raising questions about its regulatory status.

As the NFT market matures, regulators are likely to develop clearer guidelines. Key trends to watch include:

Fractionalized NFTs: These could be classified as securities if they involve shared ownership of high-value assets.

Utility Tokens: NFTs that grant access to services or platforms may face less regulatory scrutiny.

Global Harmonization: As NFTs gain traction worldwide, international cooperation on regulation will become increasingly important.

As David Sacks aptly put it, NFTs are not securities—but that doesn’t mean they’re immune to scrutiny. The future of NFTs will depend on how the industry balances innovation with compliance, ensuring that this transformative technology can thrive within the bounds of the law.

Conclusion: Is NFT the Future or a Fad?

NFTs are more than just a fad—they’re a paradigm shift in how we think about ownership and value in the digital age. Whether NFTs will continue to thrive or fade away depends on how the market and regulatory bodies evolve. What’s clear is that NFTs have opened new doors for creators and consumers, offering fresh ways to own, sell, and experience digital content. Despite volatility, NFTs are here to stay, with applications expanding into real estate, identity verification, and more. So, whether you’re here for the art, the gaming, or the potential for a big payoff, the world of NFTs is just getting started.