Unlocking the Potential of IBIT Options: How to Use Data Dashboards for Informed Trading

The landscape of cryptocurrency trading is rapidly evolving, and with it, the tools traders rely on to make informed decisions. As digital assets become increasingly integrated into traditional financial markets, platforms like SoSoValue are stepping up to provide cutting-edge data dashboards to help traders navigate this ever-changing space.

IBIT Options, a derivative instrument, allow traders to speculate on crypto price movements without owning the underlying asset. In this article, I will break down how to use these dashboards effectively for IBIT options trading, and why they are essential for making informed, profitable moves in today’s volatile crypto market.

Key Takeaways

1. IBIT vs. Bitcoin: IBIT is a financial instrument (ETF) designed to track the market performance of Bitcoin, whereas Bitcoin is the actual cryptocurrency asset. IBIT provides exposure to Bitcoin’s price movements without the need to directly hold the cryptocurrency itself.

2. The Role of IBIT Options: IBIT options are derivatives that allow traders to speculate on Bitcoin's price movements without owning the underlying asset. They offer flexibility, potential for profits, and predefined risk/reward parameters, making them an attractive alternative to direct crypto trading.

3. The Importance of Data Dashboards: Platforms like SoSoValue provide essential tools including real-time price tracking, volume analysis, and sentiment tracking to help traders make informed decisions. These dashboards are crucial for maximizing opportunities and mitigating risks in the volatile IBIT options market.

Understanding IBIT Options

The iShares Bitcoin Trust ETF (IBIT) is a financial product designed to provide exposure to Bitcoin in a regulated and traditional manner. By holding Bitcoin directly, investors are exposed to its price fluctuations, which makes it an appealing asset for both retail and institutional investors.

However, with the launch of IBIT options, traders now have an even more dynamic way to engage with Bitcoin’s price movements without needing to buy or hold the underlying asset. IBIT options work just like other financial derivatives, but they are tied to the performance of IBIT shares, which track the price of Bitcoin. This gives traders the flexibility to speculate on Bitcoin’s price movements through options, with predefined risk and reward parameters. This flexibility is especially important in a market as volatile as crypto, where rapid price changes can provide significant opportunities for profit—or loss.

IBIT Options are structured around two main types:

1. Call Options: These give the holder the right (but not the obligation) to buy the underlying asset at a predetermined price (strike price) before a specific expiration date. Traders use Call Options when they expect the price of cryptocurrency to rise.

2. Put Options: These give the holder the right (but not the obligation) to sell the underlying asset at a predetermined price before a specific expiration date. Traders use Put Options when they expect the price of cryptocurrency to fall.

For example:

If you buy a Bitcoin Call Option with a strike price of 50,000 and Bitcoin’s price rises to 60,000, you can exercise the option to buy Bitcoin at 50,000 and immediately sell it at 60,000, pocketing the $10,000 difference (minus the premium paid for the option).

Conversely, if you buy a Bitcoin Put Option with a strike price of 50,000 and Bitcoin’s price drops to 40,000, you can sell Bitcoin at $50,000, even though the market price is lower, locking in a profit.

Key Features of IBIT Options

1. Leverage: IBIT Options allow traders to control a large position with a relatively small amount of capital. For example, instead of buying 50,000 worth of Bitcoin, you might pay a 5,000 premium for a Call Option that gives you exposure to the same price movement.

2. Limited Risk: Unlike futures trading, where losses can exceed your initial investment, the maximum loss with IBIT Options is limited to the premium paid for the option.

3. Flexibility: Traders can use IBIT Options for various strategies, including speculation, hedging, and income generation.

4. No Ownership Required: You don’t need to hold the underlying cryptocurrency, which simplifies the process and reduces risks like wallet security or regulatory concerns.

While simpler than other derivatives, IBIT options still require a solid understanding of market mechanics and strategies. Now, once you understand the basics of IBIT options, the key to successful trading with IBIT options lies in the data—the more you know about market trends, volume, liquidity, and price action, the better your chances of making profitable moves. And this is where SoSoValue's Data Dashboards come into play.

To navigate these risks and maximize opportunities, traders rely on data dashboards like those offered by SoSoValue. These tools provide:

Real-Time Price Data: Track cryptocurrency indices and spot trends.

Historical Analysis: Backtest strategies using past market data.

Custom Alerts: Get notified when key thresholds (e.g., strike prices) are reached.

Risk Metrics: Monitor volatility, open interest, and funding rates to make informed decisions.

So, how can you use SoSoValue’s Data Dashboards to enhance your IBIT options trading?

Unlocking Market Insights: 5 Essential Tools in SoSoValue's Data Dashboards

1. Price Movement Tracking: Your Window to the Market

At the heart of every successful trade is a deep understanding of price behavior. The Price Movement Tracking feature on SoSoValue’s dashboard gives you real-time data on the fluctuating prices of IBIT options. By tracking these price movements, you can spot trends, analyze historical data, and make predictions about future price changes.

How to Use It:

Filter by Timeframes: SoSoValue’s dashboard lets you track price movements across various timeframes—daily, weekly, or monthly. This is essential for understanding short-term volatility versus long-term trends.

Identify Patterns: By using historical data, you can spot recurring patterns in Bitcoin’s price movements. For instance, do Bitcoin’s price jumps often coincide with certain market conditions? Or, do specific events like regulatory news or market sentiment shifts tend to lead to a correction? These insights are crucial for making data-driven trading decisions.

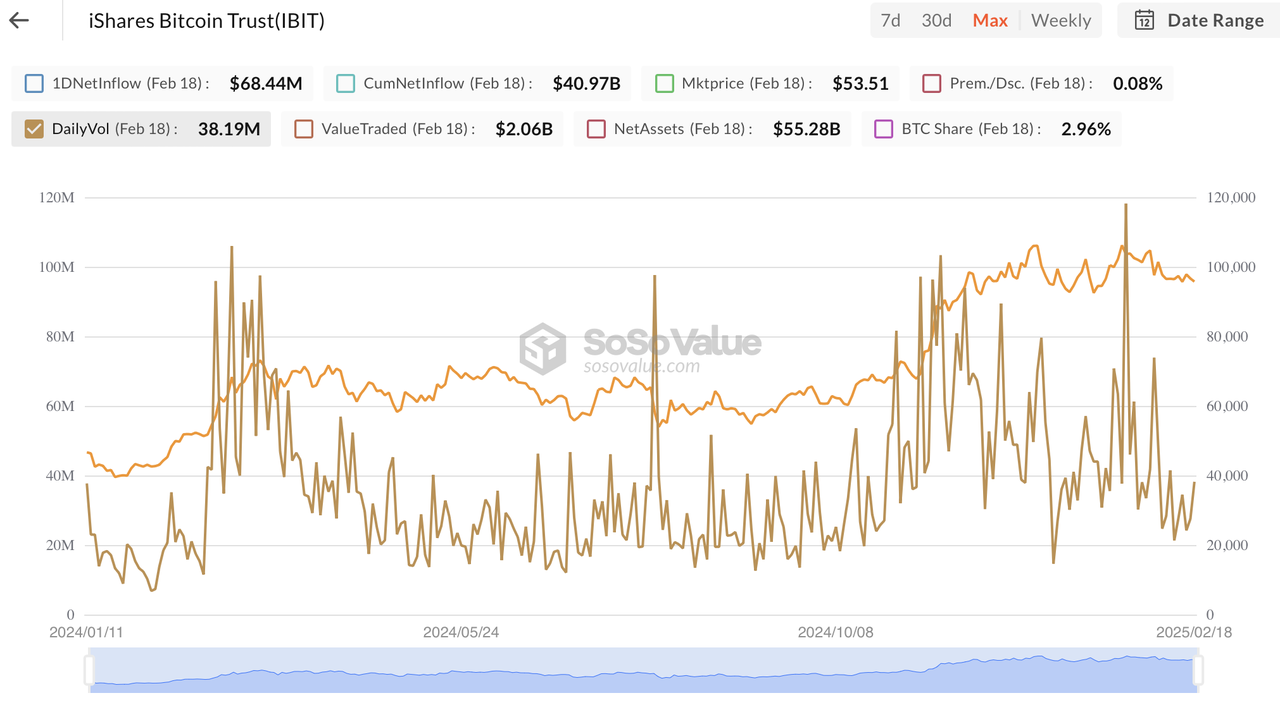

2. Volume Analysis: Gauging Market Sentiment

When it comes to options trading, volume is one of the most significant indicators for assessing market sentiment. Higher volume usually indicates increased confidence in a particular trade or trend. Conversely, low volume might suggest a lack of conviction, often preceding a reversal or uncertainty in the market.

SoSoValue’s Volume Analysis tool provides a clear view of trading activity for IBIT options. By analyzing volume, you can better understand whether a trend is gaining momentum or is about to fizzle out.

How to Use It:

Compare Volume Trends: Look for spikes in volume, which often correlate with significant price movements. When trading IBIT options, high volume typically means higher liquidity and potentially lower transaction costs.

Monitor Volume Patterns: Is the trading volume growing over time, or does it fluctuate in sync with Bitcoin’s price action? Understanding these volume patterns can help you determine when to enter or exit trades.

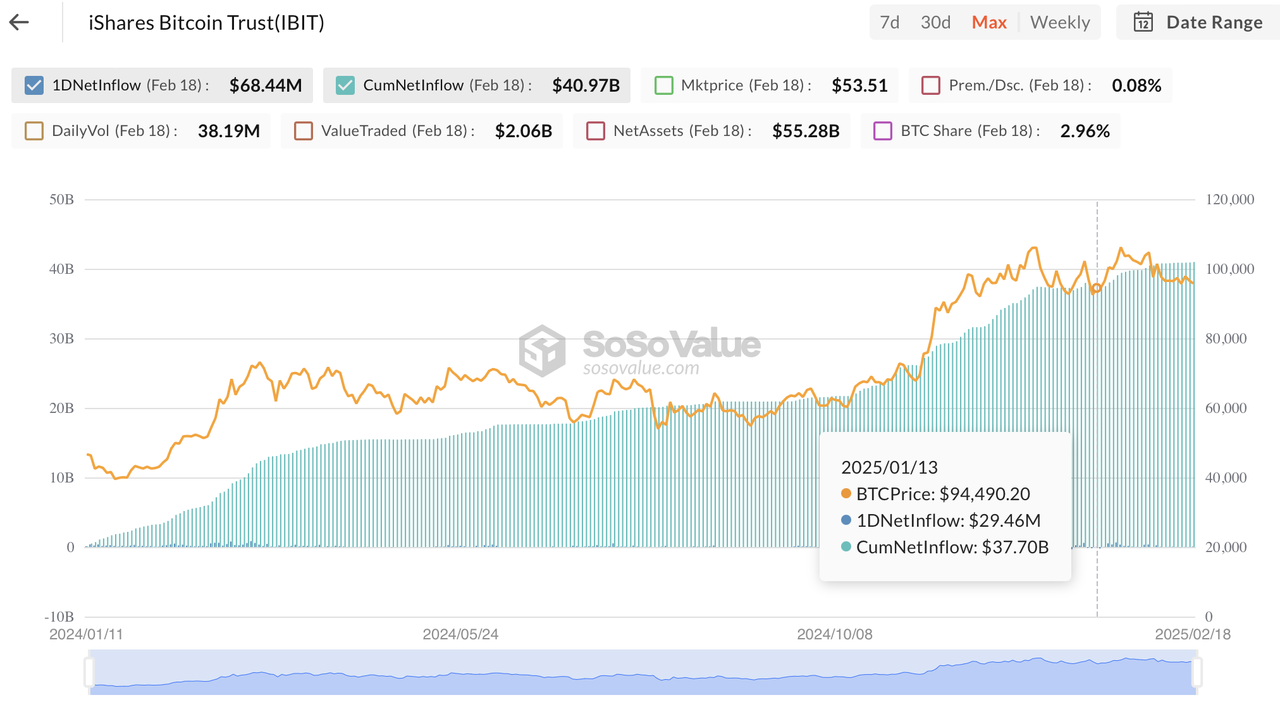

3. CumNetInflow: Long-Term Trends in Capital Flow

Similar to 1DNetInflow, CumNetInflow tracks capital inflows, but on a cumulative basis over time. This tool helps traders identify longer-term trends in the market. Traders can use this data to assess whether the market is generally bullish or bearish over a prolonged period. A steady rise in CumNetInflow could encourage a long-term trading strategy, while a decline might suggest caution and a shift towards short-term strategies.

How to Use It:

Capital Inflows and Market Sentiment: If the cumulative net inflow into the IBIT ETF continues to increase, it typically indicates that investors are optimistic about Bitcoin’s long-term outlook, driving more capital into the market.

Impact on Price Movement: The inflow of long-term capital often provides support for the price of the IBIT ETF, as more capital means increased buying pressure, which can drive the price higher.

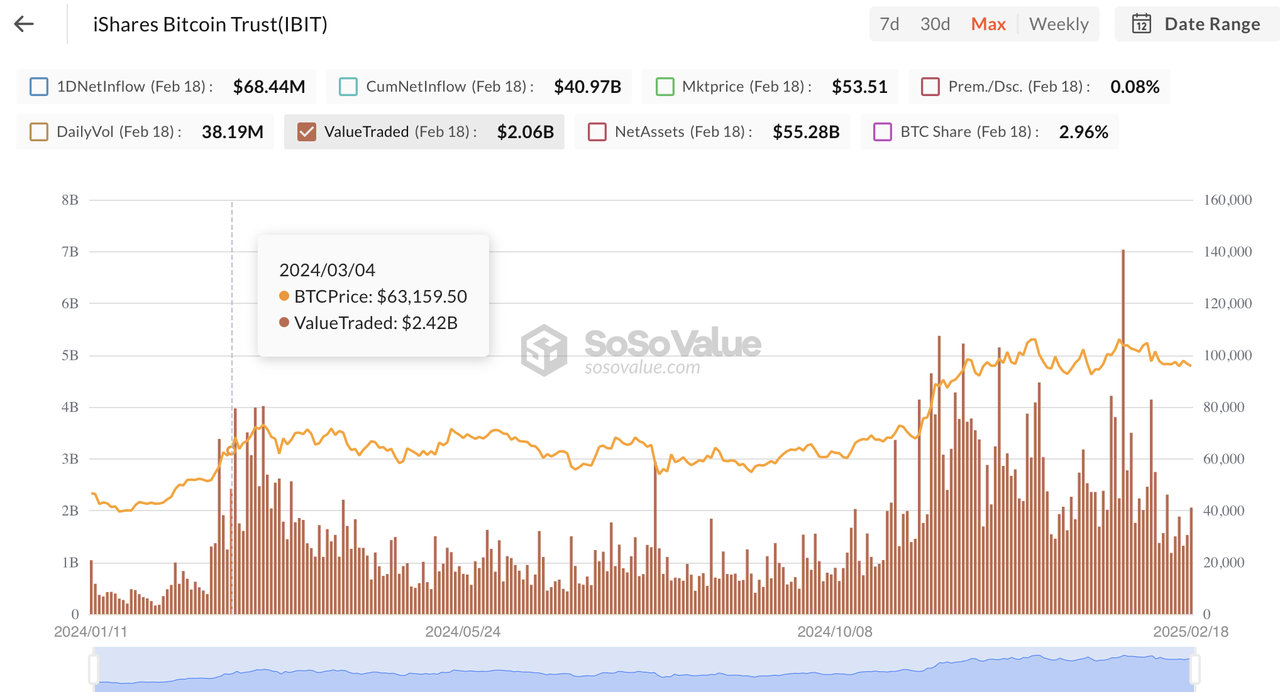

4. Value Traded: Measuring Market Activity and Liquidity

Value Traded refers to the total value of IBIT options or IBIT ETF transactions within a specified time period. It is typically a quantitative representation of trading volume, reflecting the activity levels of both buyers and sellers, essentially representing the total trading amount in the market.

How to Use It:

Market Activity: High trading volume typically indicates strong demand for IBIT options or ETFs, with more active trading and deeper market depth.

Liquidity: High trading volume reduces transaction costs, especially when the bid-ask spread is narrower, allowing traders to enter and exit the market at more favorable prices.

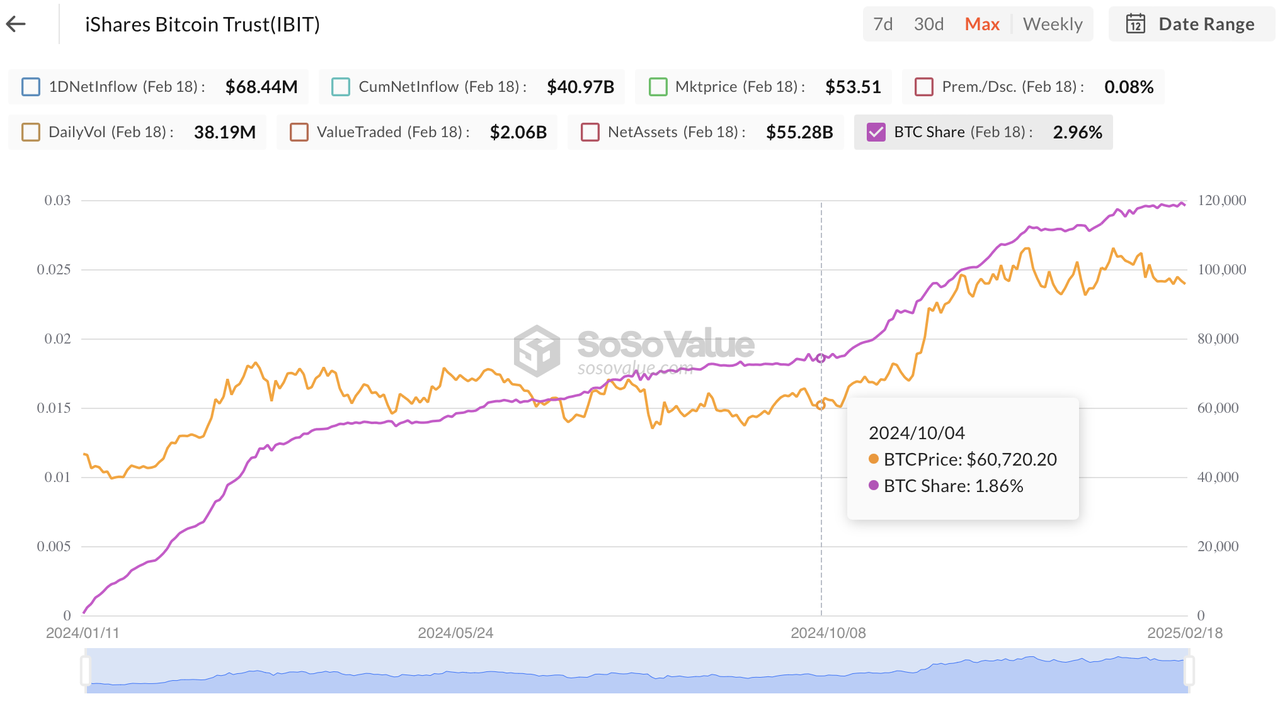

5. BTC Share: Tracking Bitcoin's Market Influence

The BTC Share metric tracks the percentage of total market capitalization that Bitcoin represents compared to other assets within the IBIT ecosystem. Understanding Bitcoin’s market share can provide traders with a sense of how dominant Bitcoin is in relation to other cryptocurrencies and IBIT options. A high BTC Share might suggest that Bitcoin remains the primary driver of market trends, while a declining share could indicate growing interest in altcoins or other digital assets. Monitoring BTC Share allows traders to adjust their strategies based on Bitcoin’s dominance in the broader crypto market.

The Role of BTC Share for IBIT:

Price Volatility: The level of BTC Share directly impacts the price volatility of IBIT.

Investor Expectations: Changes in BTC Share may influence investors' expectations regarding IBIT's future performance, which in turn can affect market sentiment.

Conclusion: Empowering Your IBIT Trading Strategy

In the fast-paced world of cryptocurrency trading, the difference between profit and loss often comes down to the information you have at hand. SoSoValue’s Data Dashboards provide traders with the critical data needed to make informed decisions about IBIT options. So whether you’re a seasoned trader or just starting, these dashboards will help you unlock the power of informed trading, turning complex data into profitable opportunities.

The landscape of digital asset trading is evolving, and the introduction of IBIT options is just the beginning. With tools like SoSoValue’s data dashboards, traders can stay ahead of the curve, making smarter, data-driven decisions that unlock the full potential of this exciting new market. Ready to Start? Enter SoSoValue's data dashboards—your one-stop shop for tracking, analyzing, and maximizing the potential of IBIT options.