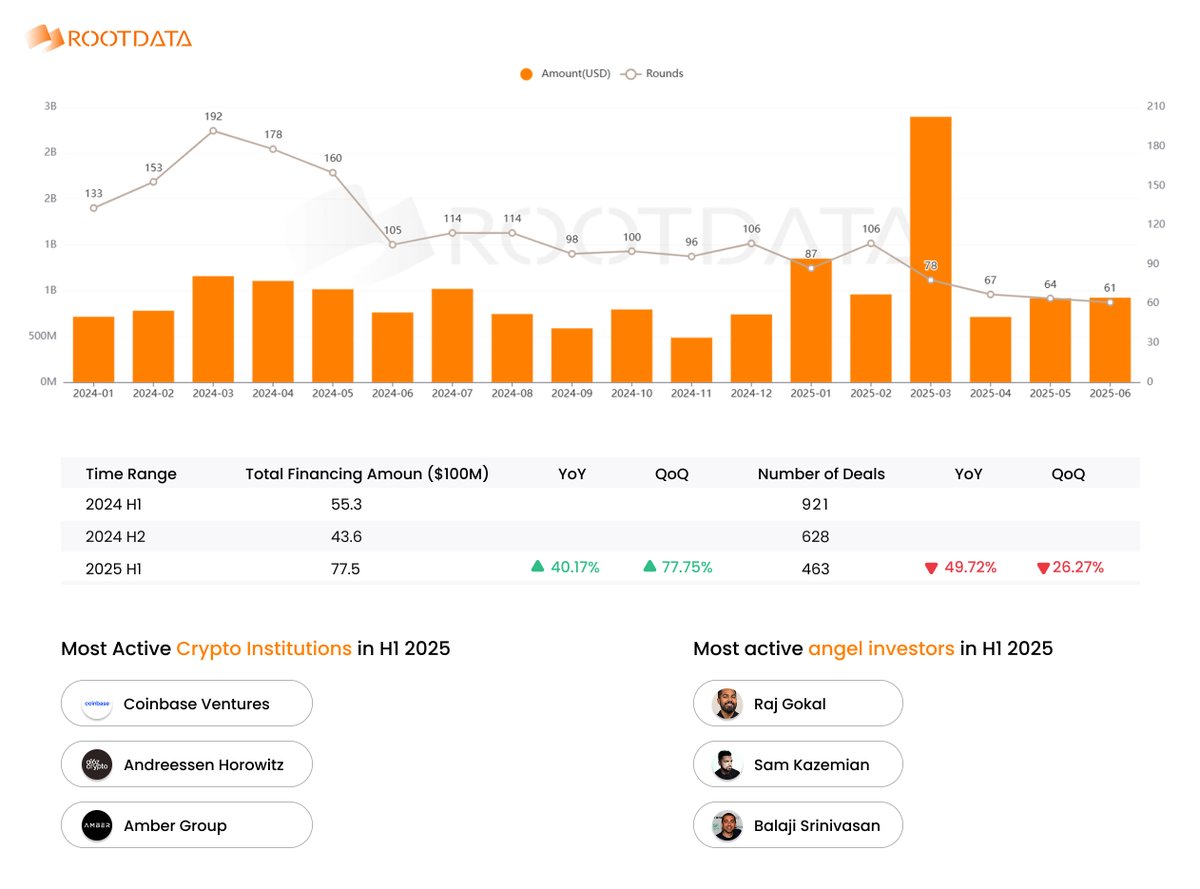

📊 $7.75 Billion Raised in H1 2025: Crypto VC Trends Toward Larger Rounds, Sector Rotation, and Surging M&A Activity

In the first half of 2025, the crypto primary market raised a total of $7.75 billion, marking a 40.17% year-over-year (YoY) increase and a 77.75% quarter-over-quarter (QoQ) increase. March alone accounted for $2.895 billion, driven largely by @binance's $2 billion round. Excluding this outlier, the average monthly fundraising amount remained around $950 million, with an average deal size of $12.42 million and a median of $5.425 million.

A total of 463 fundraising events occurred during the period, averaging 77 per month — down 49.72% YoY and 26.27% QoQ.

In terms of sectors, CeFi (Centralized Finance) took the lead with $2.719 billion in funding, surpassing the previously dominant infrastructure track, which raised $1.87 billion.

M&A activity also surged, with 66 acquisition deals recorded in H1 2025 — a 60.9% increase from 41 deals in H2 2024. Additionally, public crypto-related companies, such as @circle and @solstrategies_ , raised a combined $2.233 billion, setting a new record high for publicly listed firms in the space.

The most active investors of the first half included @cbventures, @a16zcrypto, and @ambergroup_io, each participating in over 20 deals. Other notable participants included @animocabrands, @GSR_io, @SeliniCapital, @1kxnetwork, and @mirana. On the angel investor front, Raj Gokal, Sam Kazemian, and Balaji Srinivasan were the most active.

In summary, H1 2025 saw a significant increase in total fundraising volume, while the number of deals continued to decline, maintaining a multi-year trend. The market shows signs of concentration in large-scale fundraising, increased M&A activity, and shifting investor preferences across sectors. At the same time, more capital is flowing toward the more liquid public equity markets.