How Crypto Changed After FTX's Fall 🤔

Remember FTX’s crash in 2022? It was chaos, and many thought crypto was done for. But something unexpected happened—Bitcoin came back stronger than ever.

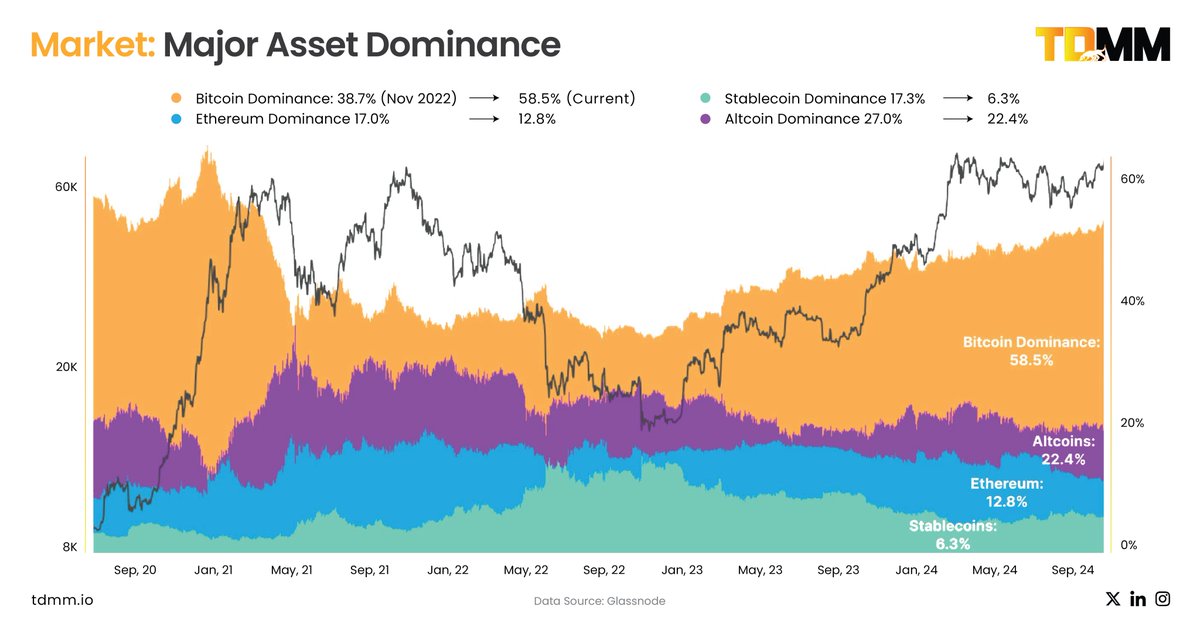

When @FTX_Official fell apart, fear gripped the market. Risky investments fell out of favor as trust became paramount. Bitcoin became the go-to asset, boosting its market dominance from 38.7% to 58.5%, adding an impressive $1.13 trillion in value.

While Bitcoin grew, stablecoins like #$USDT and #$USDC carved out their niche as reliable digital dollars. Their combined market value climbed to $155 billion, as they became essential for trading and payments in unstable economies.

But @ethereum didn’t fare as well. Despite its major upgrade, Ethereum’s market share dropped from 17% to 12.8%. The reason? Investors turned conservative, seeing Bitcoin as the ultimate and safest bet.

Institutional interest further contributed to Bitcoin’s meteoric rise. ETFs attracted big players, inspiring retail investors to follow suit. Bitcoin's growth outpaced other cryptocurrencies by a remarkable 214%.

And guess what? Bitcoin smashed records, hitting a new high of $90,000! Right now, it's trading at $91,727. But according to Cathie Wood of ARK Invest, this is just the beginning - Bitcoin still has "a long way to go."

The big takeaway?

FTX’s downfall didn’t kill crypto, it matured it. Bitcoin solidified its status as digital gold, stablecoins became everyday tools, and the market shifted its focus to safety and trust.

Stay tuned for more market insights.

𝗣𝗦: 𝗧𝗵𝗶𝘀 𝗶𝘀 𝗻𝗼𝘁 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗮𝗱𝘃𝗶𝗰𝗲. 𝗔𝗹𝘄𝗮𝘆𝘀 𝗱𝗼 𝘆𝗼𝘂𝗿 𝗼𝘄𝗻 𝗿𝗲𝘀𝗲𝗮𝗿𝗰𝗵.

#Bitcoin #Ethereum #Stablecoins #CryptoRecovery #BitcoinDominance #CryptoTrends