Matrixport: Hedge funds may reduce ETF sales and reassess arbitrage spreads in late March

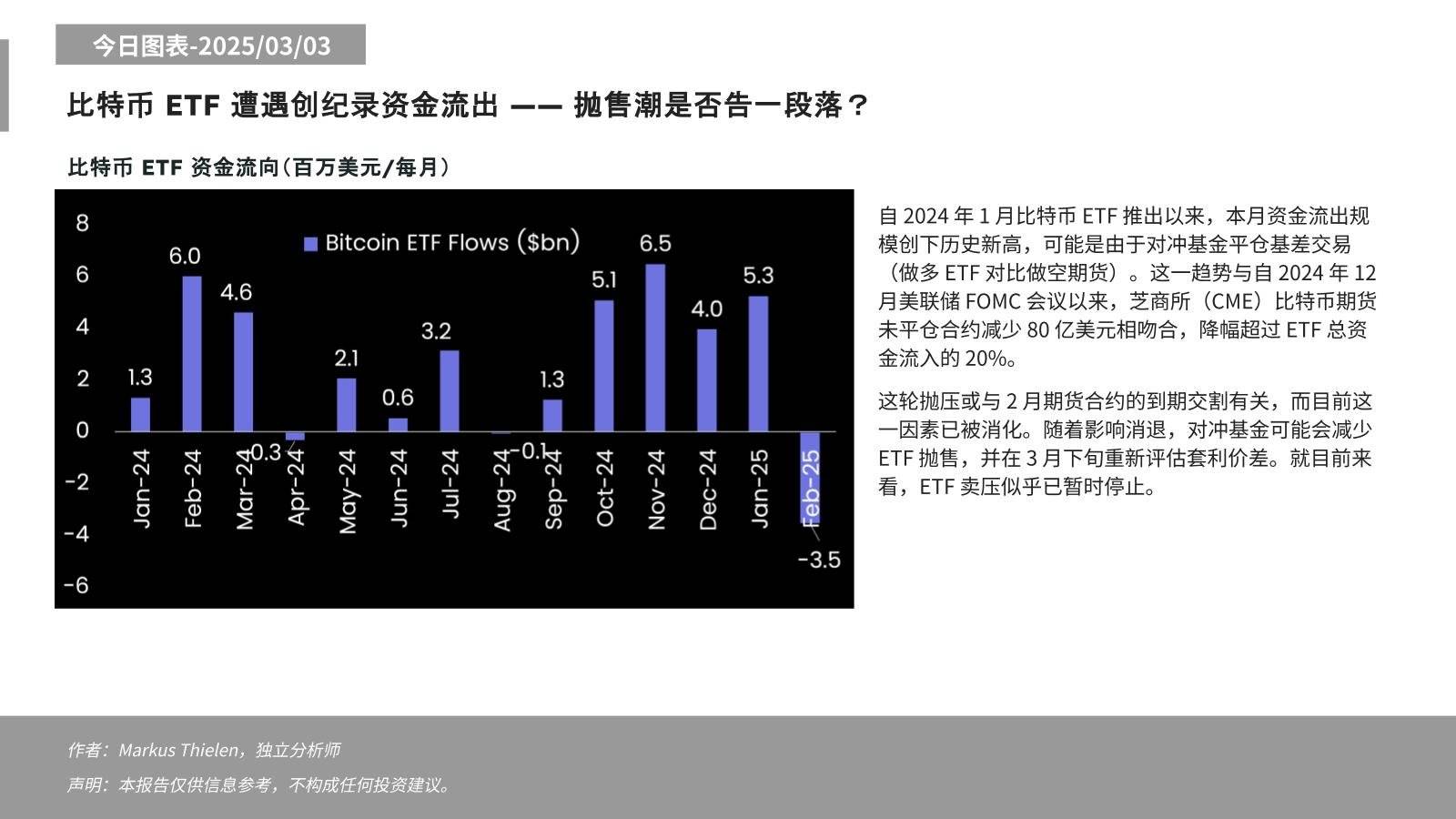

According to a report from Matrixport on March 3, in February, Bitcoin ETF outflows reached $350 million, marking the largest monthly outflow since its launch in January 2024. This phenomenon may stem from hedge funds closing basis trades (going long on ETFs while shorting futures). This trend aligns with the reduction of $8 billion in open contracts for Bitcoin futures on the Chicago Mercantile Exchange following the Federal Reserve's FOMC meeting in December 2024, which exceeds the 20% decline in total ETF inflows.

Analysts believe that this round of selling pressure may be related to the expiration and delivery of February futures contracts, a factor that the market has now absorbed. As the impact diminishes, hedge funds may reduce ETF sell-offs and reassess arbitrage spreads in late March. Current signs indicate that ETF selling pressure seems to have temporarily halted.