OpenEden

EDEN

OpenEden Timeline

OpenEden Token unlock

OpenEden Token allocation

OpenEden BasicReport a Data Error

OpenEden Info

OpenEden Intro

OpenEden offers 24/7, on-chain access to tokenized US Treasury securities for Web3 CFOs, DAO treasury managers, and buy-side institutional investors seeking low-risk, highly liquid crypto cash management solutions.

We are the first tokenized real-world asset (RWA) issuer to receive a Moody's "A-bf" bond fund rating. Since launching in early 2023, OpenEden has already become the largest issuer of tokenied US Treasuries in Asia and Europe.

As part of our end-to-end tokenization stack, OpenEden is directly involved through its licensed investment management entity which manages its BVI-registered professional fund, which issues the $TBILL tokens and custodises the underlying assets with licensed third party custodians.

OpenEden Unlock & AllocationReport a Data Error

OpenEden Token unlock

OpenEden Token allocation

Q&A about OpenEden Tokenomics

Explore the tokenomics of OpenEden(EDEN) and review the project details below.

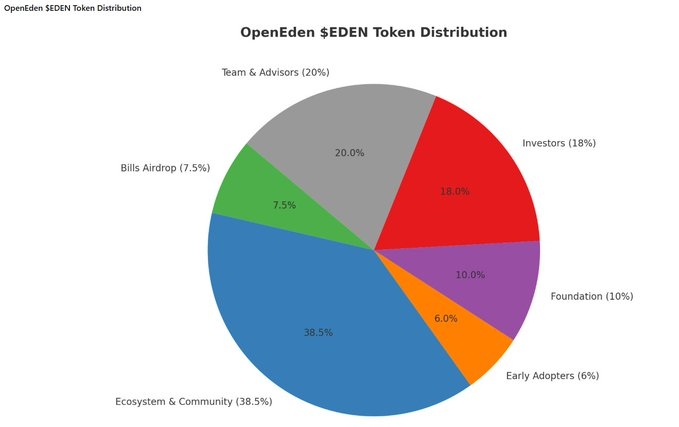

What is the allocation for OpenEden(EDEN)?

The maximum supply of EDEN is 1,000,000,000 (one billion) tokens. EDEN is designed to reward long-term alignment through mechanisms such as the EDEN Hodler Bonus and carefully structured vesting schedules.

Ecosystem & Community (38.5%): The largest share is dedicated to driving OpenEden’s growth. Tokens are unlocked at TGE to fund staking rewards, liquidity mining, exchange listings, and ecosystem incentives that expand adoption and participation.

Bills Airdrop (7.5%): Distributed to Bills Campaign participants via a fair launch, aligned with long-term holders through the EDEN Hodler Bonus mechanism.

Early Adopters (6%): Reserved for early supporters who helped bootstrap OpenEden’s adoption and TVL growth since 2023, with a similar long-term alignment mechanism as the Bills Airdrop.

Foundation (10%): Designed to ensure OpenEden’s sustainability, with 20% unlocked at TGE and the remainder subject to a vesting schedule. This allocation funds operational needs, grants, governance initiatives, token buybacks, and future expansion.

Investors (18%): Allocated to strategic capital partners, subject to a 6-month cliff and 24-month linear vesting, recognizing their role in bootstrapping OpenEden’s early development.

Team & Advisors (20%): Reserved for the builders and advisors behind OpenEden, also subject to a 6-month cliff and 24-month linear vesting to align long-term contributions.